BOISE, Idaho — Gas, milk, eggs, diapers. The price of just about everything is up these days due to inflation.

So, what to do about it?

One of the country's financial leaders made a stop in Boise this week to talk with people about the economy and policies.

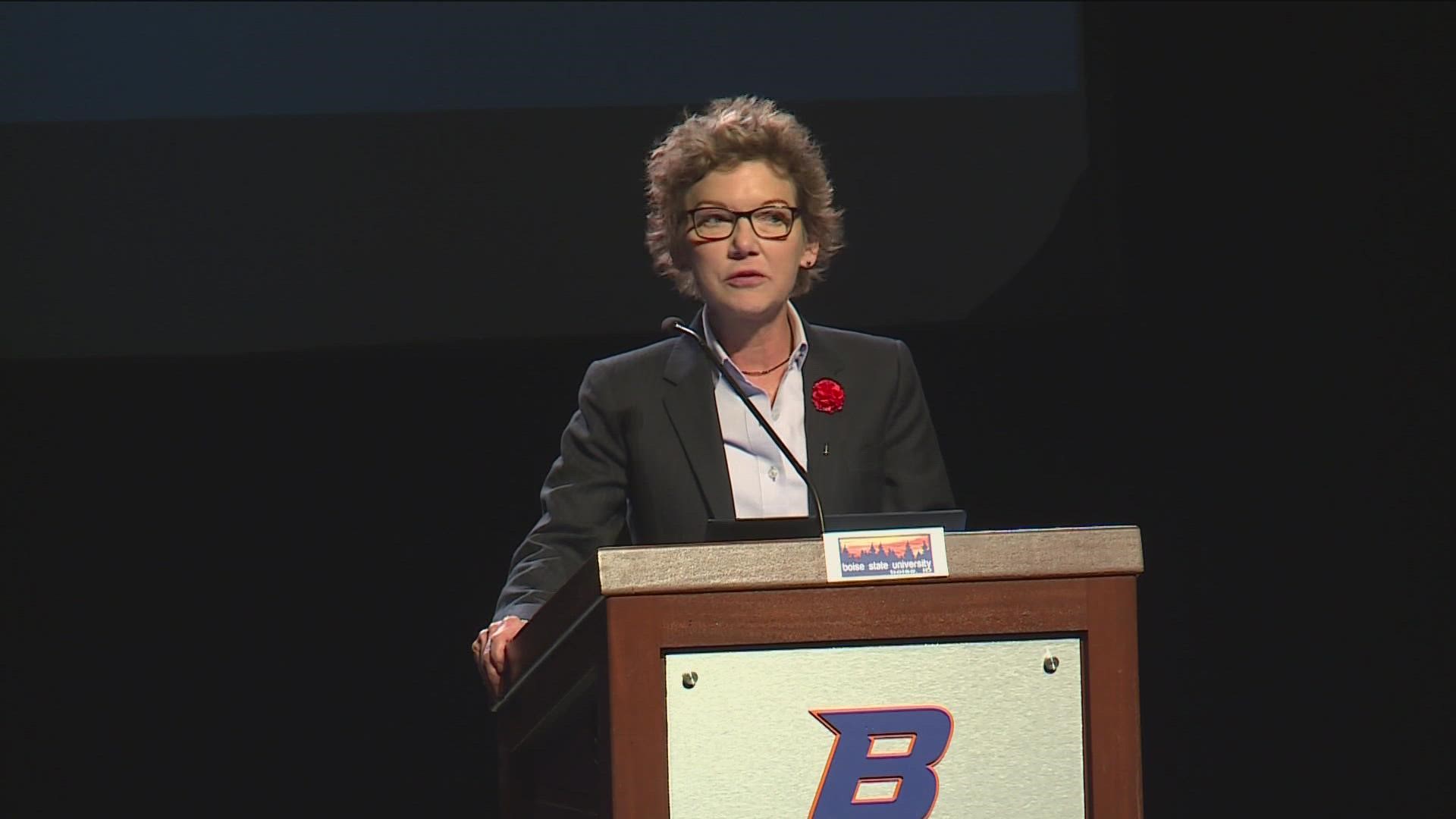

Mary C. Daly, President and CEO of the Federal Reserve Bank of San Francisco, gave a keynote address at Boise State University on Thursday. Daly's speech was called "The Singularity of the Dual Mandate." It discussed high inflation and the Fed's dual mandate.

Daly oversees nine western states, including Idaho, as part of the Fed's 12th district.

KTVB spoke with Daly before her speech.

"My job, and the job of all the teams who work with me, is we need to get out and talk to people, because ultimately, the policies we make are for everyone who lives in our communities," Daly said. "If we don't know what people are feeling, what they're struggling with, and what they want, then it's very difficult to make policy. Here's what I hear no matter where I go: people want jobs, and they want low inflation."

In the 70's, Congress gave the Fed a mandate for how it should operate. The goals of it state that the Fed should work to maximize employment, and keep price stability. The two points are what come together to form the "dual mandate."

To keep prices stable, the Fed has a target 2% inflation rate. The inflation rate has topped that mark for over a year now.

To combat rising inflation, the Fed has hiked its benchmark interest rate in three consecutive meetings.

"The Fed is very resolute in brining inflation down. It's eating away at peoples' lives and livelihoods and we understand that," Daly said. "That's why we've taken a fairly aggressive course of raising interest rates, because those raising of interest rates is the thing we need to do to bring the economy back down to a slower pace so demand and supply get back in balance and when people take a paycheck home, they know it holds value from month-to-month."

Daly expects the interest rate hikes to continue.

"I do think we'll see more interest rate hikes in the future. Really, we've projected that in our documentation and communications," Daly said. "We need to do that because inflation is still far, far above our target. It's making it impossible to live month-to-month, and that's not an equation that's sustainable for the economy or for individuals."

Daly said there has been a "corroding of wages" due to the Consumer Price Index rising much faster than hourly wages, especially the prices of necessities.

Domestic supply has also been crippled by the pandemic, war in Ukraine, and labor shortage.

This means the average worker has been losing ground, especially those with low-to-moderate incomes.

Inflationary pressure also influences mortgage rates.

"In Boise it was ironically the poster-child for a city that's growing and growing," Daly said. "Coastal citizens are moving in and moving house prices up and first-time homebuyers who grew up here in Boise or in Idaho are being bid-out by cash buyers. That has cooled off as the interest rates have risen and the economy has slowed a little bit, but we need to do more of that to get this back in balance."

The Fed's goal is to find price stability through raising interest rates, while avoiding a "harsh recession." Like the recession America saw in the early 80's when inflation was elevated for over a decade. Daly said that decade of high inflation seeped into the psychology of the American economy.

Daly said that's not the case with today's economy, and that inflation expectations and psychology, especially with 5-year projections, have remained "well anchored" around the 2% inflation goal.

"Ultimately the goal is to deliver a sustainable economy where people who want to buy their first home or second home can do so without worrying that they'll be completely priced out of the marketplace," Daly said.

You can watch Daly's speech on the Federal Reserve Bank of San Francisco's website.

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist: