BOISE, Idaho — The Idaho State Tax Commission (ISTC) released a memo in early October documenting the state's maximum homeowner's property tax exemption dating back 1980.

Idaho law allows qualifying homeowners to exempt up to 50% of their home's assessed value from property taxes until hitting the maximum limit. From 2007 to 2016, the House Price Index (HPI) dictated the maximum limit. The maximum exemption would increase or decrease depending on the housing market.

Idaho lawmakers changed the maximum exemption in 2016 to a stagnant number. The ISTC's memo shows the stagnant 2023 maximum exemption is nearly $100,000 less than it would have been if the law did not change.

"The housing market has gone crazy in Idaho these last several years," ISTC Property Tax Policy Specialist, Kathlynn Ireland said. "You would have a much larger portion of your assessed value being exempted from property tax and you would receive a lesser tax bill."

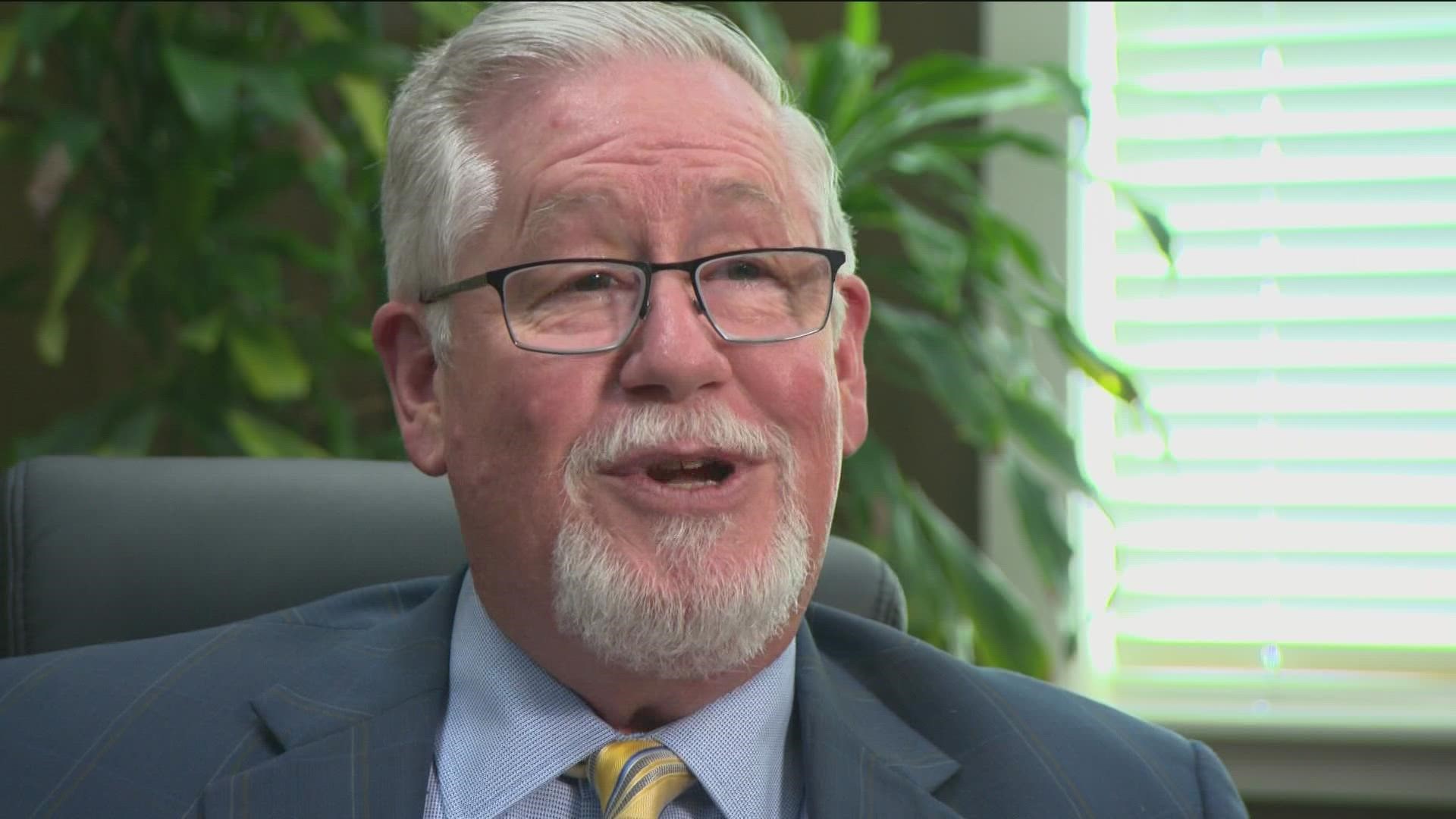

Rep. Bruce Skaug (R-Nampa) proposed draft legislation in the 2022 legislative session to bring back an HPI-based maximum exemption. The bill received 40 co-sponsors, according to Rep. Skaug, but, it never got heard in committee.

"Well, of course it's frustrating when you have a good idea and 40 people are backing you in the House to get it done, but it's up to the chairman," Skaug said. "I support the idea we have good, strong chairmen, and they can put a bill in the drawer if they want, but not when there is 40 co-sponsors."

Skaug's experience is not unique, according to Idaho Democratic Party Chair Rep. Lauren Necochea (D-Boise). There is a pattern of Republican committee chairs preventing indexed homeowner's exemption bills from getting heard.

"I think we have enough numbers to pass a bill, it's getting a bill heard that's the problem," Necochea said. "I've brought personal bills. I've co-sponsor bills with Republicans to address the homeowners exemption. We can't get a hearing, because republican leaders don't want us to go back to an indexed exemption."

Both Rep. Necochea and Rep. Skaug suggest the top interest in denying a HPI-based homeowner's exemption is to continue pushing the property tax burden off commercial property, and onto the resident sector.

"I own commercial property and I love the tax break I'm getting, but it's at the expense of the homeowner, and as a homeowner, I don't like that," Skaug said. "The bill for indexing is already drafted. It's ready to go. It has support across the state. It has been run by several assessor in different counties as well as clerks and they're backing the bill."

Rep. Necochea criticizes Republicans that support HPI-based homeowner's exemption bills but who also support committee chair leadership who have blocked the same bills.

"This is a top priority to me," Necochea said. "I'm talking to my Republican colleagues one-on-one whenever I can."

Rep. Skaug believes bipartisan support will pass some sort of bill come the next legislative session.

"Cream will raise to the top. If this is the best cream of the crop, it will be the top bill and go through. I am pretty confident we will get this bill heard in committee this time," Skaug said.

Join 'The 208' conversation:

- Text us at (208) 321-5614

- E-mail us at the208@ktvb.com

- Join our The 208 Facebook group: https://www.facebook.com/groups/the208KTVB/

- Follow us on Twitter: @the208KTVB or tweet #the208 and #SoIdaho

- Follow us on Instagram: @the208KTVB

- Bookmark our landing page: /the-208

- Still reading this list? We're on YouTube, too: