BOISE, Idaho — There's a chance your paycheck could be bigger than normal over the next several months.

President Trump's plan to put more money in people's pockets took effect on Tuesday. It's called a payroll tax deferral - a tax holiday if you will.

Since Trump made the announcement last month, there's been some confusion as to what the tax deferral will mean and who it will help.

Jeff Beebe, a Boise-based CPA with over four decades of experience, has had his head wrapped around the payroll tax deferral for the last month.

He told KTVB that tax laws and rules change on a regular basis - yearly, if not more often. But he also said he's never seen an executive order like this in his four decades of crunching numbers.

He explained how it will work:

"If you make less than $4,000 every two weeks, you have the opportunity to defer your FICA or Social Security payment... through the end of the year," Beebe said.

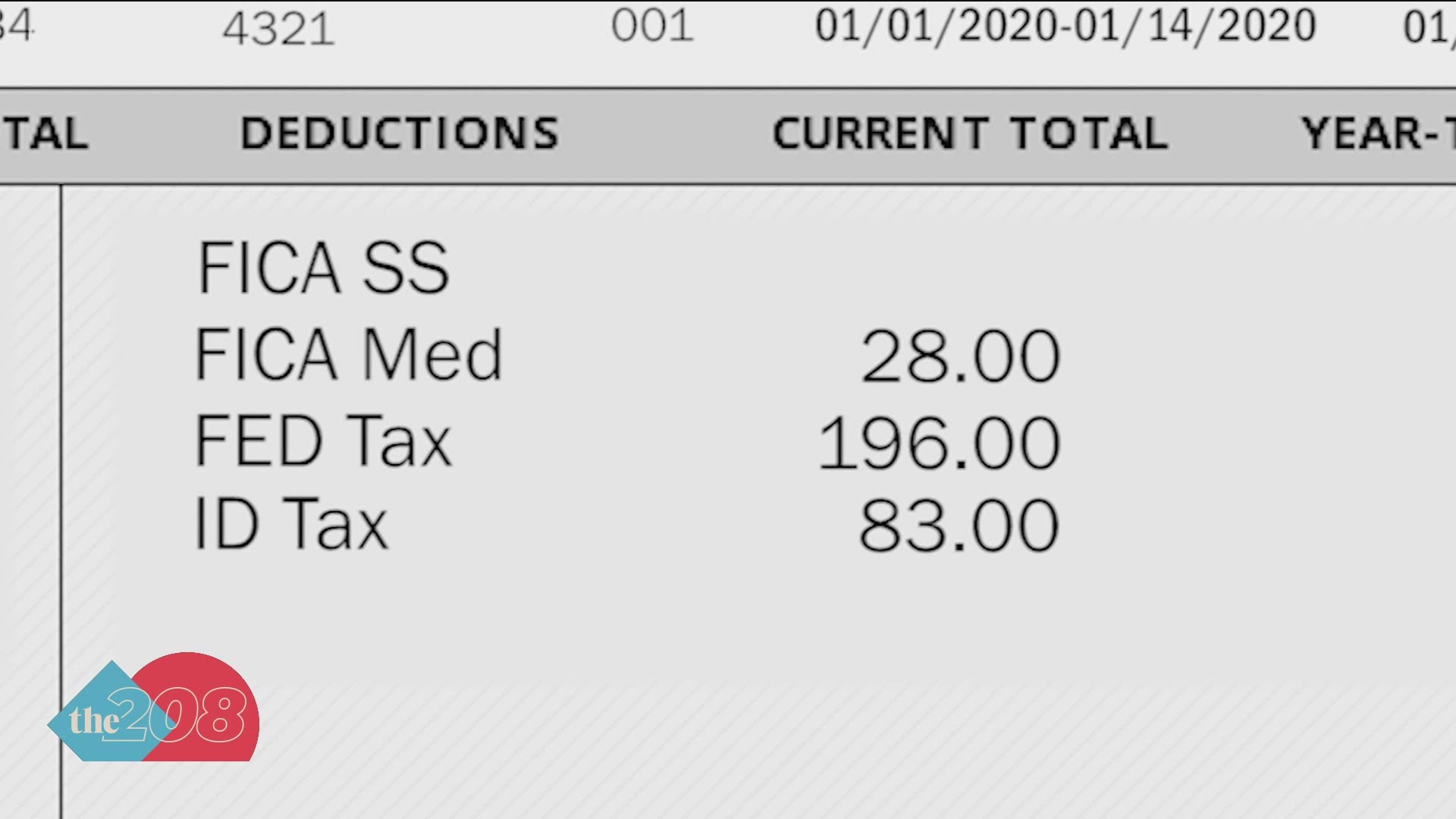

What would that mean for you? Take a look a probably the least favorite part of your paystub, the portion that breaks down the taxes taken out.

As an example, let's say you make $50,000 a year and get a paycheck every two weeks. Federal and state governments take about 15% - to the tune of $196 and $83, respectively.

There's also Medicare, which takes 1.45%, or about $28 in this example. Then there's the FICA or Social Security tax that takes out 6.2% of your gross income. If you make $50,000 a year, that would be $119 every two weeks.

So if you decide to enroll in the payroll tax deferral program, your paycheck would be $119 more for the next four months.

But there's a catch: the money will have to be paid back next year.

"It doesn't go away, it just defers off until the first four months of 2021," Beebe said.

That means your paycheck will see a swing in the other direction starting in January. And in our example, instead of a $119 deduction for FICA, you would see a $238 increase for the first four months of the year.

It's a short-term benefit designed to help those who are currently feeling the pinch from lost hours due to COVID-19.

"I've had a lot of people asking about it, but once they understand how that deferral really works people are not that excited about it," Beebe said.

He added that the IRS explanation of the plan is a bit unclear, but as he understands it, a company has to choose to offer this option to its employees. And employers will still have to pay their half of the Social Security tax during the deferment period.

Beebe doesn't believe that reducing the money paid into Social Security would hurt the program short-term because that money would be paid back.

But there are some questions as to whether the president can legally change tax policy without the approval of Congress. In fact, some members of Congress are asking to vote to overturn the executive order.

Legal or not, Beebe said, the deferment already applies to all federal employees as of Sept. 1.

Join 'The 208' conversation:

- Text us at (208) 321-5614

- E-mail us at the208@ktvb.com

- Join our The 208 Facebook group: https://www.facebook.com/groups/the208KTVB/

- Follow us on Twitter: @the208KTVB or tweet #the208 and #SoIdaho

- Follow us on Instagram: @the208KTVB

- Bookmark our landing page: /the-208

- And we also turn each episode into a podcast on Spotify or Podbeam

- Still reading this list? We're on YouTube, too: