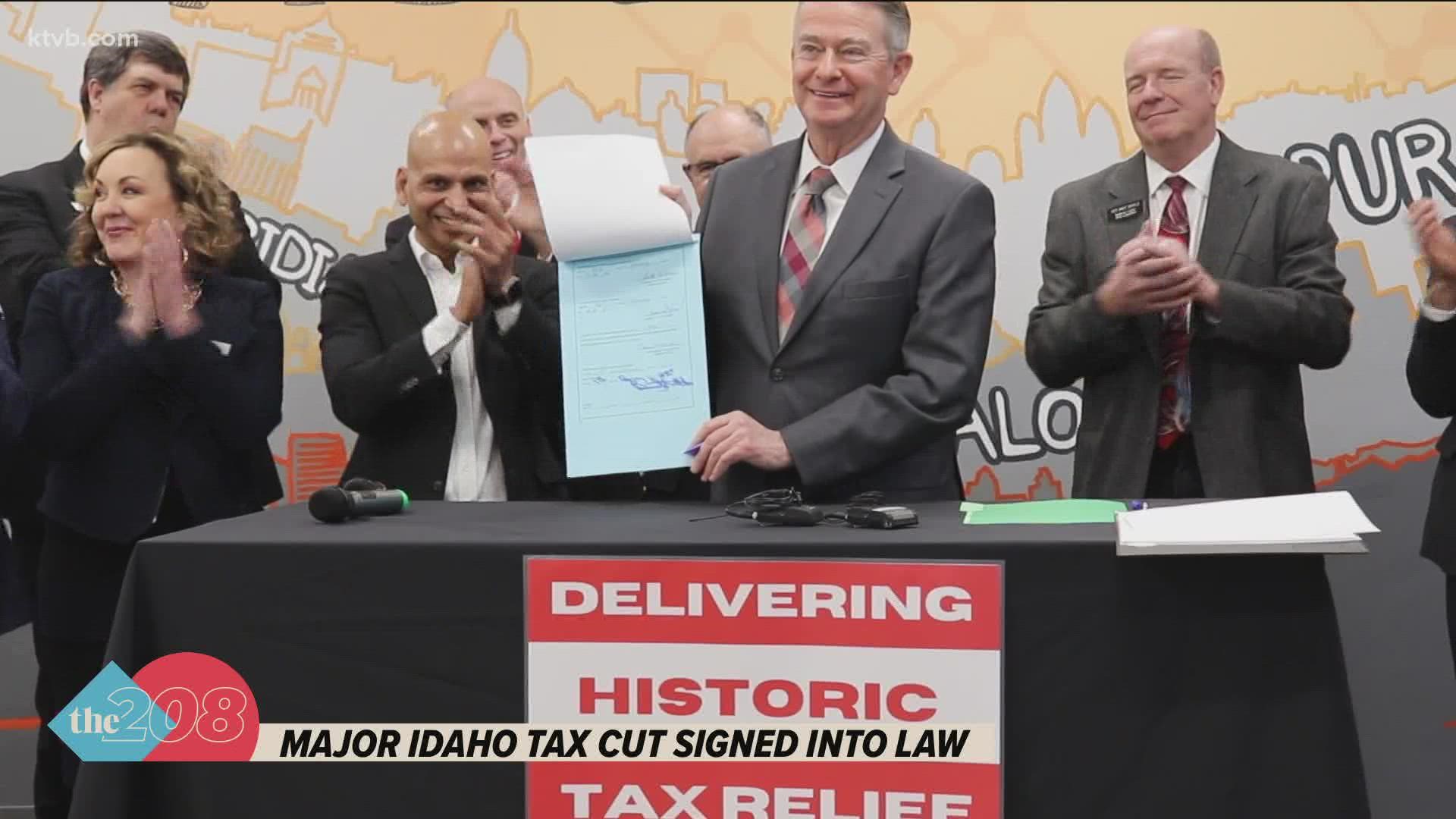

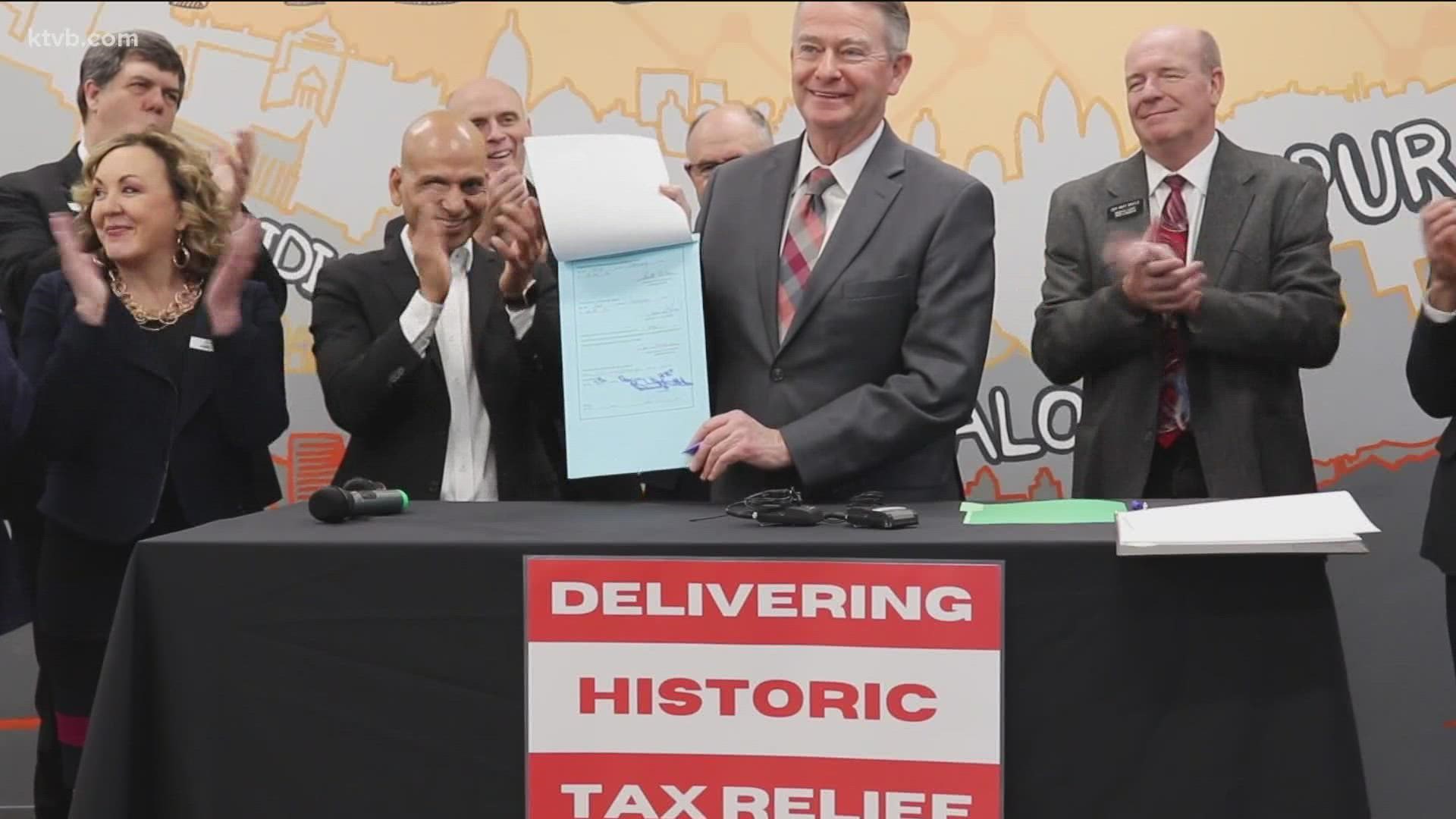

BOISE, Idaho — Gov. Brad Little signed a record tax relief bill into law Friday, approving $600 million in cuts.

House Bill 436 includes $350 million in one-time rebates and $251 million in ongoing income tax rate reductions for people and corporations.

The bill consolidates Idaho’s income tax brackets from five down to four, and lowers both the corporate income tax and the highest individual tax rate down to 6%.

The rebate includes 12 percent of state income taxes returned for filers during 2020, or $75 per taxpayer and dependent, whichever is greater.

The tax cut is the largest in Idaho state history. Lawmakers split largely along party lines, with proponents arguing that it would give money back to citizens and opponents saying that it disproportionately benefits the wealthy.

Little signed the bill in a ceremony at 12:30 p.m. Friday.

House Speaker Scott Bedke (R-Oakley) and Asst. House Minority Leader Lauren Necochea (D-Boise) offered their perspectives on the coming tax cut Friday evening:

Watch more Idaho politics:

See all of our latest political coverage in our YouTube playlist: