BOISE, Idaho — A bill introduced in the Idaho House Revenue and Taxation Committee on Tuesday would create a new way to distribute sales tax dollars to cities across the state.

In Idaho, sales tax dollars are collected by the state and then a portion is re-distributed to cities and counties. The bill would change how cities get those sales tax dollars.

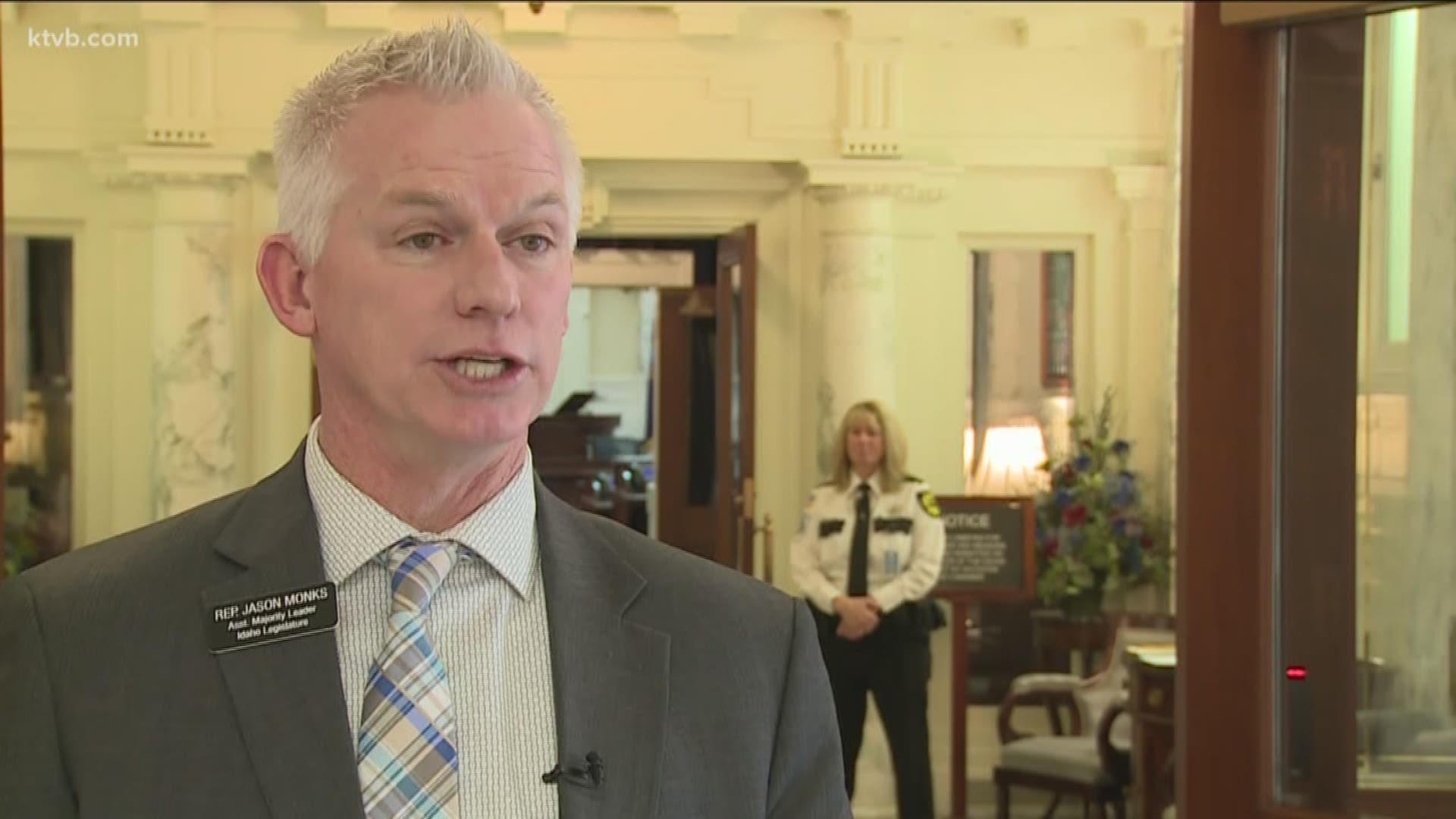

“What the problem is that cities receive a disproportionate share of the sales tax because of these archaic formulas,” said bill sponsor and assistant majority leader Rep. Jason Monks. “My bill is an attempt to try and level that and make it to where we are seeing some more equity across the board.”

Part of this formula is still based on an old system that was in place before Idaho started collecting sales tax dollars. This is what causes it to be disproportionate.

The current formula is partially based on the antiquated system of historical calculations based on the personal property tax assessed on Idahoans.

That tax is no longer used, but it taxed Idaho citizens on things like the number of pigs, chickens, cows, and other personal items they had.

“A lot of people are concerned we're going to take money from one city to give to another to levelize that field and this bill doesn't do that,” Monks said.

The state sees around a 4 to 5% increase in sales tax dollars, according to Monks. What the bill changes is where that increase in sales tax dollars go to.

“Right now, the formula is very static, it just stays there,” he said. “So, if we had 5% additional sales tax, that extra 5% goes to all the cities and just gets distributed using the old formula and arguably actually exacerbates the problem.”

Monks is proposing a change to where the increase in sales tax revenue dollars would go.

“The first 1% in increases in our sales tax gets to distributed to all the cities,” he said. “After that we're going to take the excess growth and we're going to distribute that to the cities below the average to try and bring them up.”

Two cities below the average right now are in the Treasure Valley: Meridian and Kuna.

“Currently, they're not getting what I think is their fair share of the distribution and that impacts their ability to do their jobs,” Monks said.

Rep. Lauren Necochea, (D) Boise, told KTVB she still wants to see all the details of the bill. She’s interested in seeing how gradual this change happens and wants to make sure cities that won’t be receiving more from the change won’t be hurting in the future.

A hearing for the bill hasn’t been scheduled yet, but Monks told KTVB he’s optimistic one could be scheduled as soon as next week.