BOISE, Idaho — It's a struggle finding a way to buy your first home in this housing crisis. Prices keep climbing, inventory is still too low, and mortgage rates are not dropping any more.

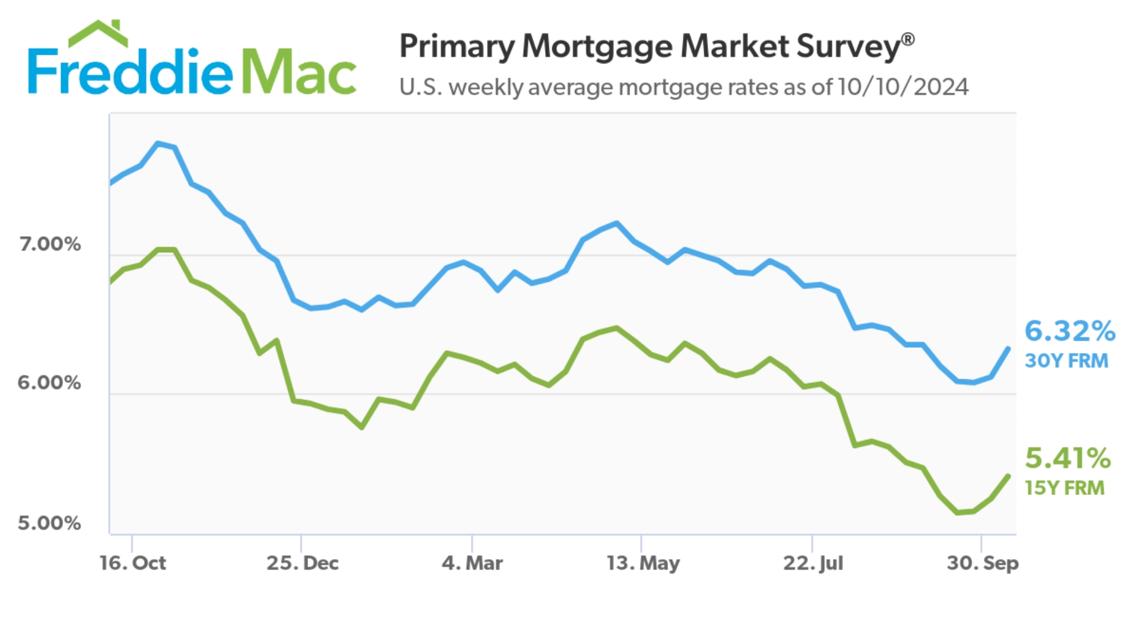

In fact, they're rising again. Freddie Mac is reporting the average 30-year rate is at 6.32%. That's up from 6.08 just two weeks ago, though it's still down more than a point from this time last year. The thing is, lots of potential homebuyers we’ve heard from expected that with the Federal Reserve lowering its key rate, that mortgage rates would plummet right after. But, according to Boise Regional Realtors President Elizabeth Hume, the mortgage rates actually dropped in anticipation of the key rate dropping, so the rates are now where they're going to be, above six percent.

And if you're hoping to see rates around three percent again, stop. Indicators are that we won't see rates like that again in our lifetime... unless we have another pandemic.

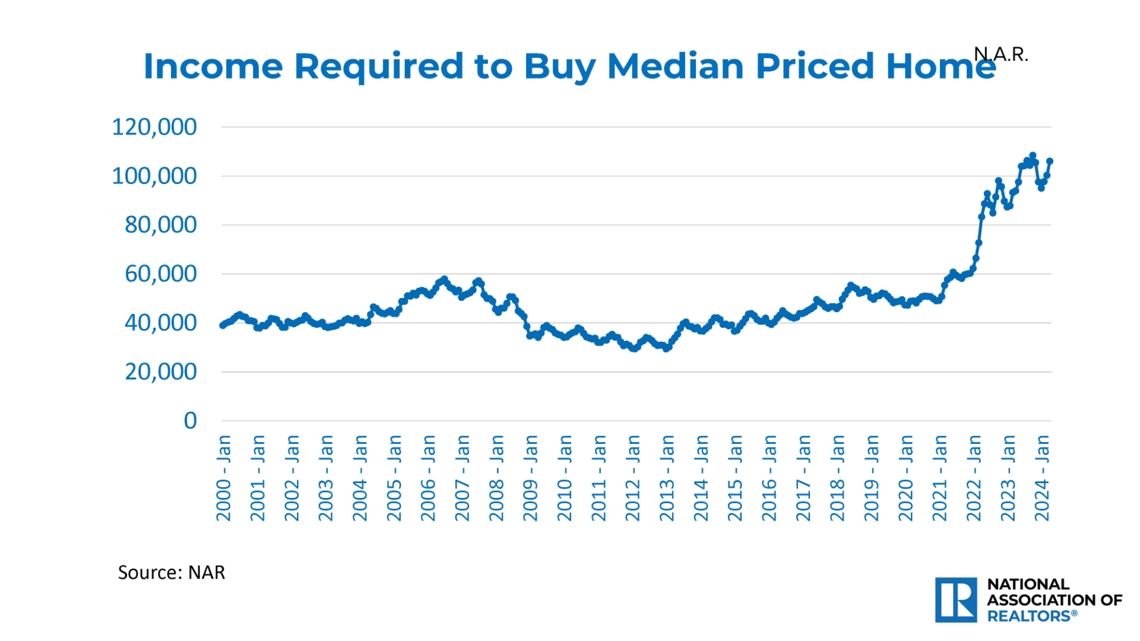

All that follows a report from the National Association of REALTORS® that the average household in America would need to earn about $114,000 a year to afford a median-priced home. That's more than doubled since just 2021. Idaho is about the same. Also, the average household in Idaho makes $40,000 less than that $114,000 figure.

So, what are potential homebuyers, especially first-time homebuyers, supposed to do? How can they break into a market with prices they can't afford because of low inventory and lower wages?

Last week, we told you that Hume said 'step one' in buying a home can be done by anyone, because it doesn't actually require any money. That's because, she says, 'step one' is simply making a plan by first talking to a lender.

"I'm guilty of it too. I don't want to go to the lender and ask how much money I can borrow. I think I might not be in the right position, or maybe I missed a credit card payment, and I don't want anyone to know about it. So, I don't want to expose my little soft underbelly of lending money. And when you go and talk to a lender, they will tell you what you need to do to get in a home. They will tell you how much money you need, how much money you need to save, what it looks like, and about how much money you could afford to get into a home. And it allows a first-time homebuyer, especially, a chance to go out there and make a plan. If I don't know how much money I need to save, or I'm making a guess that I need $20,000 or $100,000 to buy a house, I'm doing myself a disservice by not going out and getting that information firsthand. What is it that I can afford, and how much do I really need to have to put down? Because it's not as hard as people think."

Now, that doesn't mean it's not hard, it’s just not as hard as you might think. There's a program for first-time homebuyers, for instance, through Idaho Housing and Finance that only requires half-a-percent down payment. Your monthly payment would be higher, but it's a way to get in the game and start building equity and generational wealth.