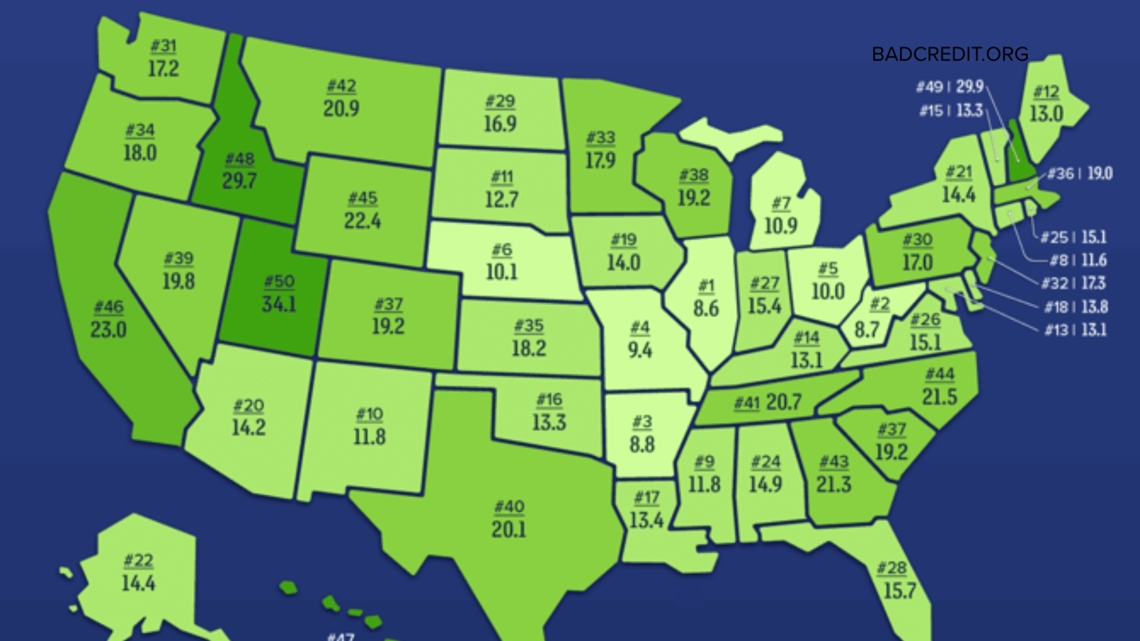

BOISE, Idaho — This map from BadCredit.org shows how long it takes for the person making each state's minimum wage to afford the average down payment on a house of 8%. The longer times are in a darker green.

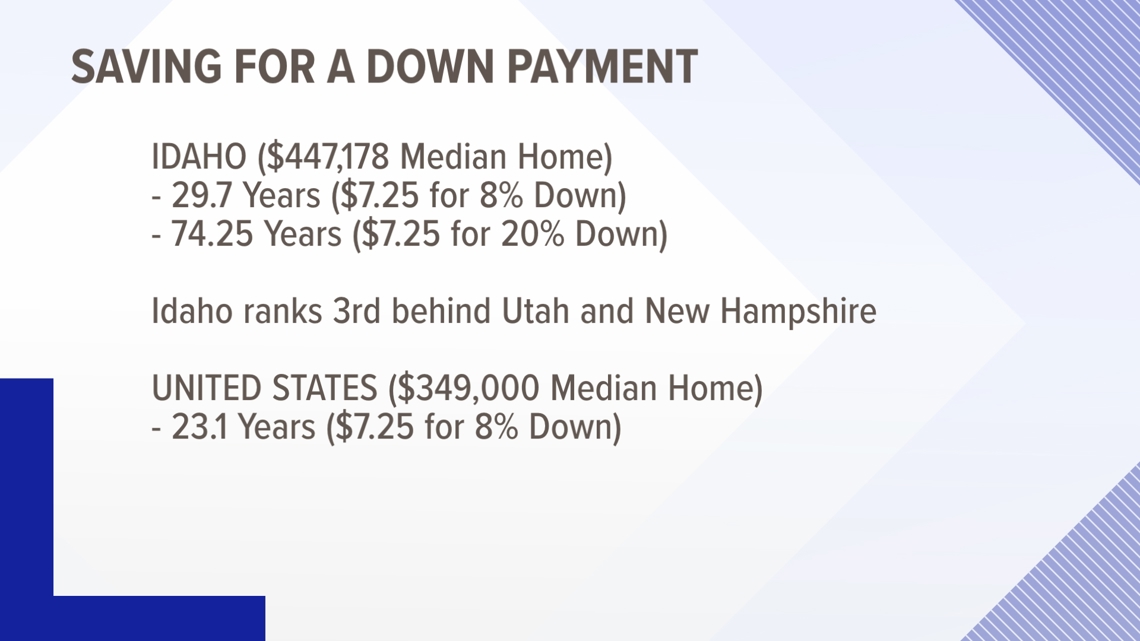

It's hard to ignore that Idaho is a very dark green. That's because it would take an Idahoan making minimum wage 29.7 years to save for a down payment on a house!

That's 3rd-highest in the nation! So, if they started saving 10 percent at 18 years old, they'd be nearly 48 before they could afford a home.

All this is on the average price for a home in Idaho, $447,178. If you want to put down 20 percent, which would lower your payment by avoiding mortgage insurance, that will take almost 75 years. That's not feasible. Again, Idaho ranks 3rd on this list, behind our neighbors to the south, Utah, and New Hampshire. Nationally, it would still take more than 23 years for a minimum wage-earner to save the average down payment for the average home.

But as depressing as all that is, it's actually worse. Kim Demma, a loan officer with Guild Mortgage with decades in the business, said someone making minimum wage would not even get approved for the loan. "The problem is you'd never be able to qualify, no matter how much you put down at minimum wage. Looking at our minimum wages, we're still at seven and a quarter. So, you couldn't save enough to afford that."

So, it's literally impossible to buy an average home around here making minimum wage. The good news, though, is that most folks are making well above minimum wage in Idaho. In fact, the state Department of Labor says the median wage is $21.27. That’s almost three times the minimum wage of $7.25. That will help.

Also, there are some very helpful down payment assistance programs out there. With good credit, Demma says first-time homebuyers can buy a house with as little as half-a-percent of their own money. Remember, a smaller down payment means a bigger monthly payment that you would have to qualify for. But Demma thinks a lot more folks should just have a conversation with a lender to see exactly what they can afford and what they need to save. "Just talk to a lender, start working on some options, and do it now. Don't wait until the like the market crashes. Don't wait until there's much better rates. Don't wait until you get this this perfect little world that you think is coming. Get in there now. Because I don't think it's going to get any better. I really don't."

So that bubble burst or market crash you may have heard people talk about and hope for, is not coming any time soon. Also, mortgage rates are ticking down, but as those drop, prices can spike, which won't help affordability.

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist:

HERE ARE MORE WAYS TO GET NEWS FROM KTVB:

Download the KTVB News Mobile App

Apple iOS: CliHck here to download

Google Play: Click here to download

Watch news reports for FREE on YouTube: KTVB YouTube channel

Stream Live for FREE on ROKU: Add the channel from the ROKU store or by searching 'KTVB'.

Stream Live for FREE on FIRE TV: Search ‘KTVB’ and click ‘Get’ to download.