BOISE, Idaho — A recent survey said that, on average, if you're buying a home in the Gem State, $375,000 will get you a place that's less than 1,200 square feet. That's according to RealtyHop. But there is some good news if you want prices to keep coming down.

According to the Intermountain MLS, we saw continued drops in homes sold and median price for July. In Ada County, the number of homes sold dropped by 4.7% and the median price dropped by 8.5%. In Canyon County, we saw similar trends, with the number of homes sold dropping by 9.0% and the median price dropping by 8.3%. In Twin Falls County, despite the median price standing pat, the market is turning frigid. There's a 31% drop in the number of homes sold month to month. We expected these numbers to climb for the summer real estate season. That is not the case.

So, you've heard good news, bad news, and here's now pretty bad news. RealtyHop says, out of the 100 biggest real estate markets in the country Boise, not Idaho, Boise ranks 40th for least affordable markets. That's even estimating the household income at $80,000. They estimate your average monthly mortgage and tax payment to be $2,457. That translates to almost 37% of your income going to housing. That's way too much. And a red flag, Portland is ranked more affordable.

Boise is also trending in the less affordable direction. How can that be, if, as we saw, prices are coming down? It's all by design. The Federal Reserve's key interest rate is at its highest level in 22 years right now. It's an effort to calm down the housing market and ease inflation.

A couple weeks ago, right after they jacked up that rate again, U.S. Federal Reserve Chair Jerome Powell said, "We have been seeing the effects of our policy tightening on demand in the most interest rate sensitive sectors of the economy, particularly housing and investments. It will take time for the full effects of our ongoing monetary restraint to be realized, especially on inflation."

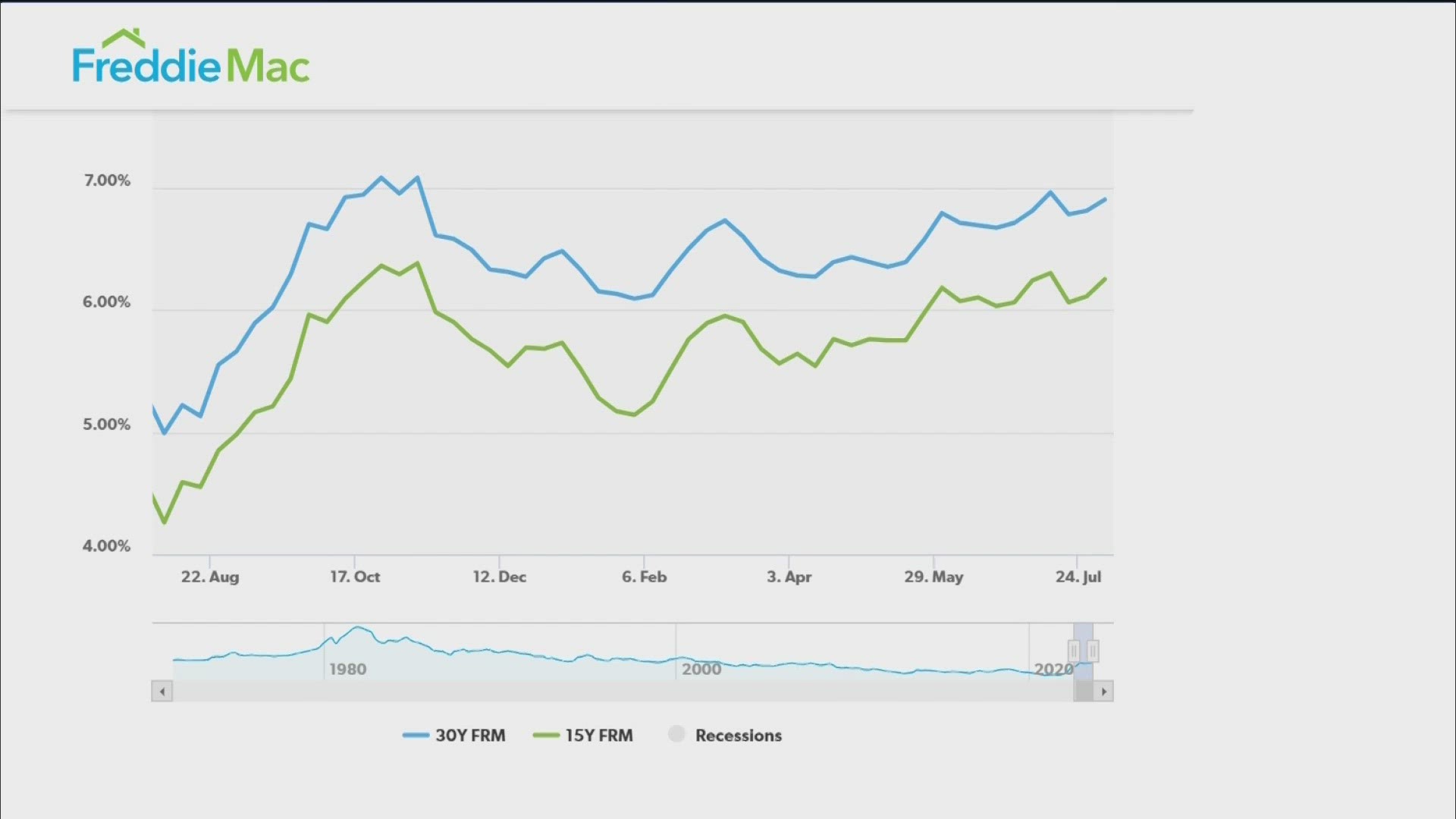

If the idea was to see mortgage rates rise with the federal rate, it's working. According to Freddie Mac, the average 30-year fixed rate loan was sitting around 5% just a year ago, and it's around 7% today. Again, this is the point. The Federal Reserve wants to make borrowing, like to buy a home, more expensive to reduce demand and drop prices.

It’s all working. But while prices are dropping, mortgage rates are rising. And that means overall mortgage payments for new buyers are staying about the same. Bottom line, again, housing in Idaho is still expensive.

Watch more 'Growing Idaho':

See the latest growth and development news in our YouTube playlist:

HERE ARE MORE WAYS TO GET NEWS FROM KTVB:

Download the KTVB News Mobile App

Apple iOS: Click here to download

Google Play: Click here to download

Watch news reports for FREE on YouTube: KTVB YouTube channel

Stream Live for FREE on ROKU: Add the channel from the ROKU store or by searching 'KTVB'.

Stream Live for FREE on FIRE TV: Search ‘KTVB’ and click ‘Get’ to download.