BOISE, Idaho — Some good news could be on the horizon for homebuyers in terms of mortgage rates dropping, but that likely means bad news for home prices.

KTVB recently did a story on the spike in apartment buildings in the area. Many of you posted your takes on social media and a lot of viewers went right to the root of the issue as you see it – the lack of affordable homes.

Hayley said that we are seeing more apartments, "because nobody can afford housing."

Karen said, "dang, so glad I bought when I did. Wow. I couldn't fathom paying as much as people do for a home."

Grey said, "the problem is multifaceted. Interest rates are very high and home prices are high."

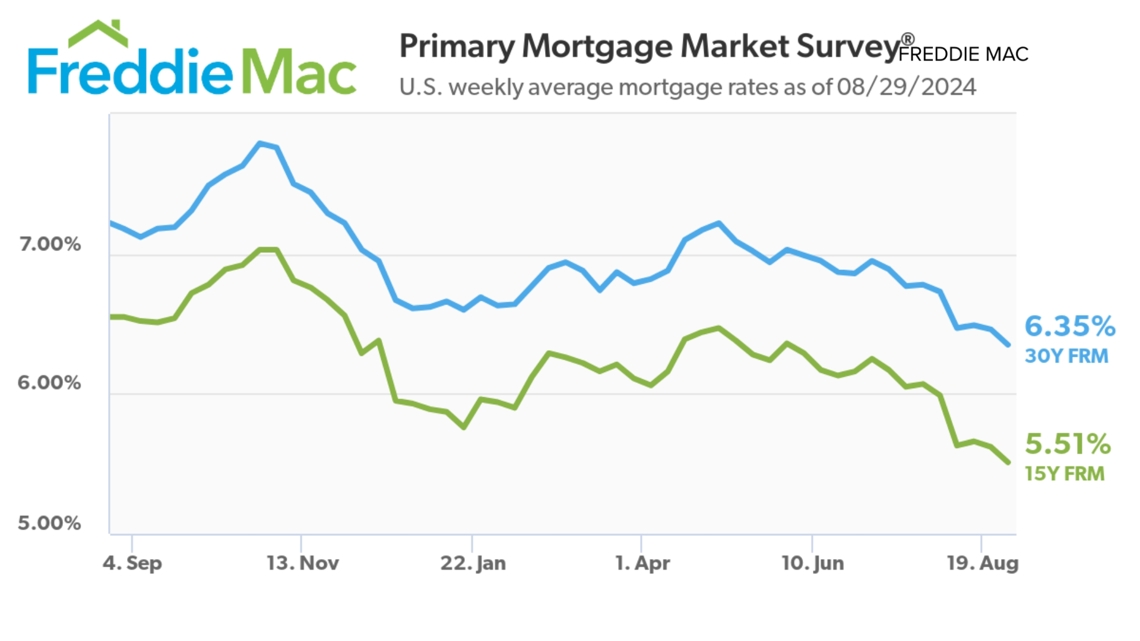

Grey is right, those interest rates are relatively high, but they are headed in the right direction. Freddie Mac says the average 30-year loan is now at 6.35%. That's the lowest it’s been since April of last year. And while it's still a far cry from the rock bottom 3% rates of a few years ago, they are going to keep dropping.

How can we say that? The process to drop those rates even more is underway. The Federal Reserve controls the key interest rate, which they said they would drop as soon as inflation slowed down enough. Fed Chair Jerome Powell said recently that inflation is where they want it, after a very long period of high inflation.

"Prior to this episode, most Americans alive today had not experienced the pain of high inflation for a sustained period," Powell said. "Inflation brought substantial, substantial hardship, especially for those least able to meet the higher costs of essentials like food, housing and transportation. High inflation triggered stress and a sense of unfairness that linger today."

Essentially, inflation is slow enough that they can finally drop their key interest rate. Mortgage rates follow that key rate, so they will drop even more. And that means housing prices will drop too, right? No. It means the exact opposite and home prices are actually already pretty high.

According to Cinch Home Services, the average homeowner in Idaho spends more than $37,000 a year on their home. That is 57% of the average take-home household income. That includes your mortgage, maintenance and taxes. That's a huge chunk of the average family's take-home pay.

It's 18% more than the national average.

But if these rates keep dropping, even if home prices go up, which they will, most people's monthly payments will be lower, hopefully. That’s unless the market really heats up, competition for homes spikes, and the prices spike because of it.