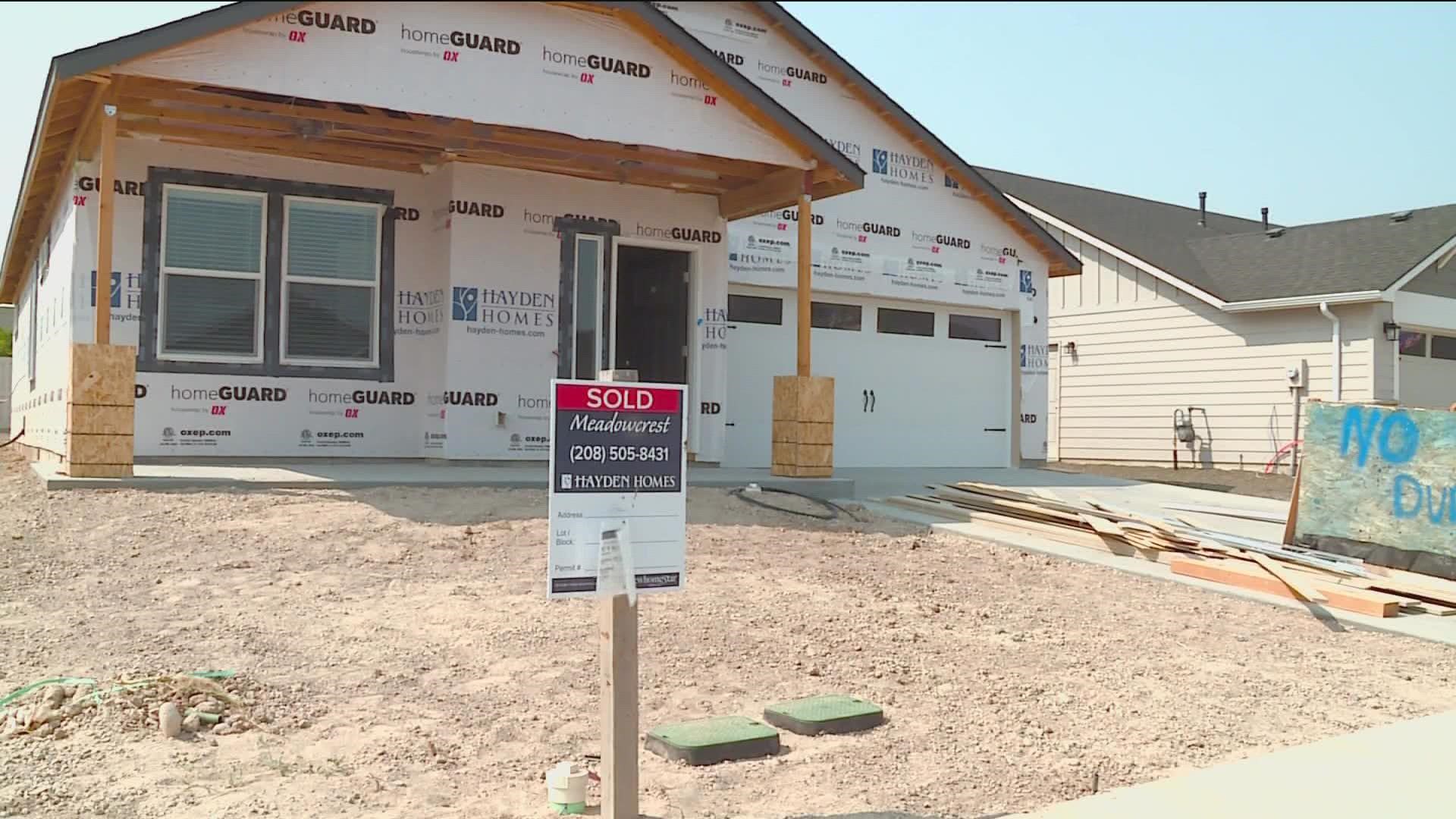

BOISE, Idaho — The Treasure Valley housing market is slowing down. You might even say it's slowing way down. But an expert I talked to said this could be a good thing, because the market was out of control and is now finally normalizing.

In Ada County and Canyon County, the number of home sales in October 2022 was down by 32 and 33 percent, respectively, when compared to October of 2021. That’s according to the Intermountain MLS.

Bottom line, people are not buying homes anywhere near the pace they have been. Katrina Weir, president-elect of the Idaho REALTORS Association, said probably the biggest reason is the rise in interest rates. According to Freddie Mac, the average 30-year mortgage rate was at a little more 3% this time last year. Today, it's over 6.6%.

"As you know, inflation is the arch enemy of interest rates,” Weir said. “So as inflation rises, interest rates, mortgage rates rise as well. And that definitely changes demand and purchasing power for some buyers and does make some of them maybe alter what they're looking for, or even pause and see if they can wait it out and see if something else will surface in the meantime."

Nobody has a crystal ball on interest rates. But, according to the Mortgage Bankers Association, most economists seem to agree they should settle around the middle 5.5% next year.

Weir said people buying fewer homes means more homes are available. For too long, there's only been a few weeks of inventory and now, she says, we're at about 3 months of housing inventory. That means it would take 3 months for all the homes for sale to be bought up. That's better, but agents say a 5 months' supply is a balanced market. So, it's not ideal, but we're starting to catch up.

Weir said it means buyers now don't have to worry about the home they want getting bought out from underneath them in the first hour it goes on sale.

"It's created more opportunity for the buyers that are in today's market, they have more choices, they have more negotiation power," Weir said. "You're not at that pace where you have to make a decision the second house comes on the market, you can actually think about it and you don't have to settle on a house that may not be right for you."

With more options, that means people are paying less for homes, right? No. If you compare median prices for October of this year to last, prices are up in both Ada (5.5%) and Canyon (2.5%) counties. Some people were hoping for a year-to-year drop, but the increases are much more modest than when we saw prices spiking after the start of the COVID pandemic. Also, Weir said, you want some normal, healthy appreciation -- which is about 4 percent. So, the prices are just like the rest of the market; here's that word again, "normalizing."

What if you want to buy a home, still cannot afford these prices, and are going to wait until, at least, the interest rates come down next year? Weir says to keep the faith, and in the meantime, save money for your down payment. If you save enough, you won't have to pay for mortgage insurance, which will save you some cash every month.

Also, if you're a first-time homebuyer, you can look into a first-time homebuyer savings account. That allows you to get a break on your state taxes for what you're saving.

Watch more 'Growing Idaho':

See the latest growth and development news in our YouTube playlist: