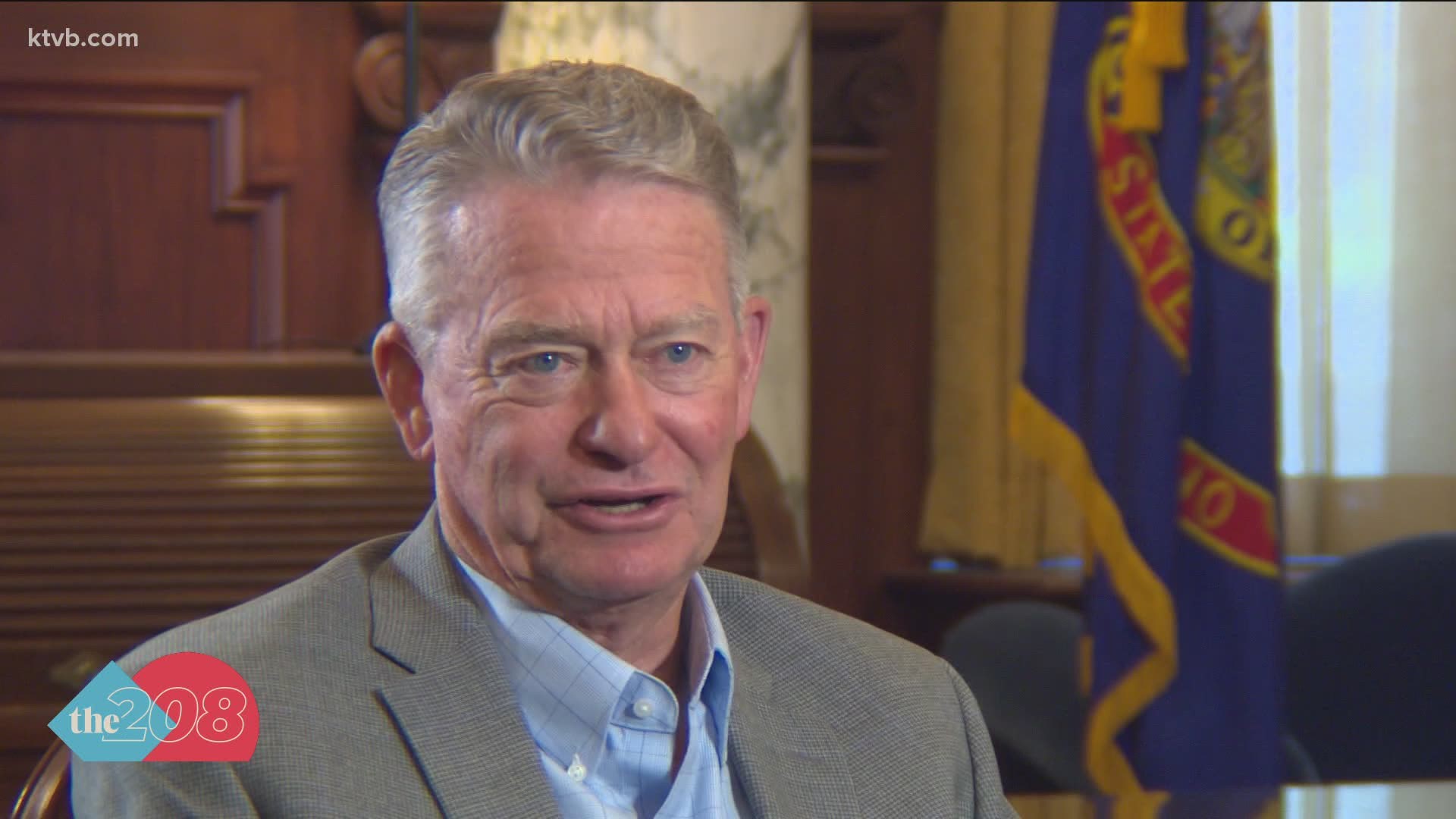

BOISE, Idaho — Idaho Gov. Brad Little announced Tuesday that the state ended its fiscal year with a record surplus of nearly $900 million.

State revenue collections exceeded $5 billion for the first time, representing 24.2% growth over the previous fiscal year. It is the single largest annual increase in General Fund revenue.

The two largest contributors to Idaho's record surplus are income tax filings, exceeding projections by $469 million, and sales tax collections of $166 million more than forecast.

"Idaho's economic numbers show even in the middle of a global pandemic, conservative governing works," Little said. "We have worked hard to curb government spending while providing tax relief and making investments where they count. We are seeing the impact of those conservative principles in action."

Earlier this year, the Idaho Legislature approved the largest tax cut in state history and made strategic investments in transportation, education, and other key areas as part of the governor’s "Building Idaho's Future" plan.

Little told KTVB previously that he plans to use this record surplus provide more tax relief and investments in key areas such as education.

"The tax dollars of Idaho's citizens are accounted for in accordance with the law, and the state of Idaho closed its fiscal year with a remarkable surplus," State Controller Brandon Woolf said. "Due to prudent leadership and our fiscally conservative values, the state of Idaho was better prepared for the hardships of the pandemic and has come out of these unprecedented times with the best economic footing in the nation."

The June revenue figures posted by the Division of Financial Management today are available here.

Watch more Idaho politics:

See all of our latest political coverage in our YouTube playlist: