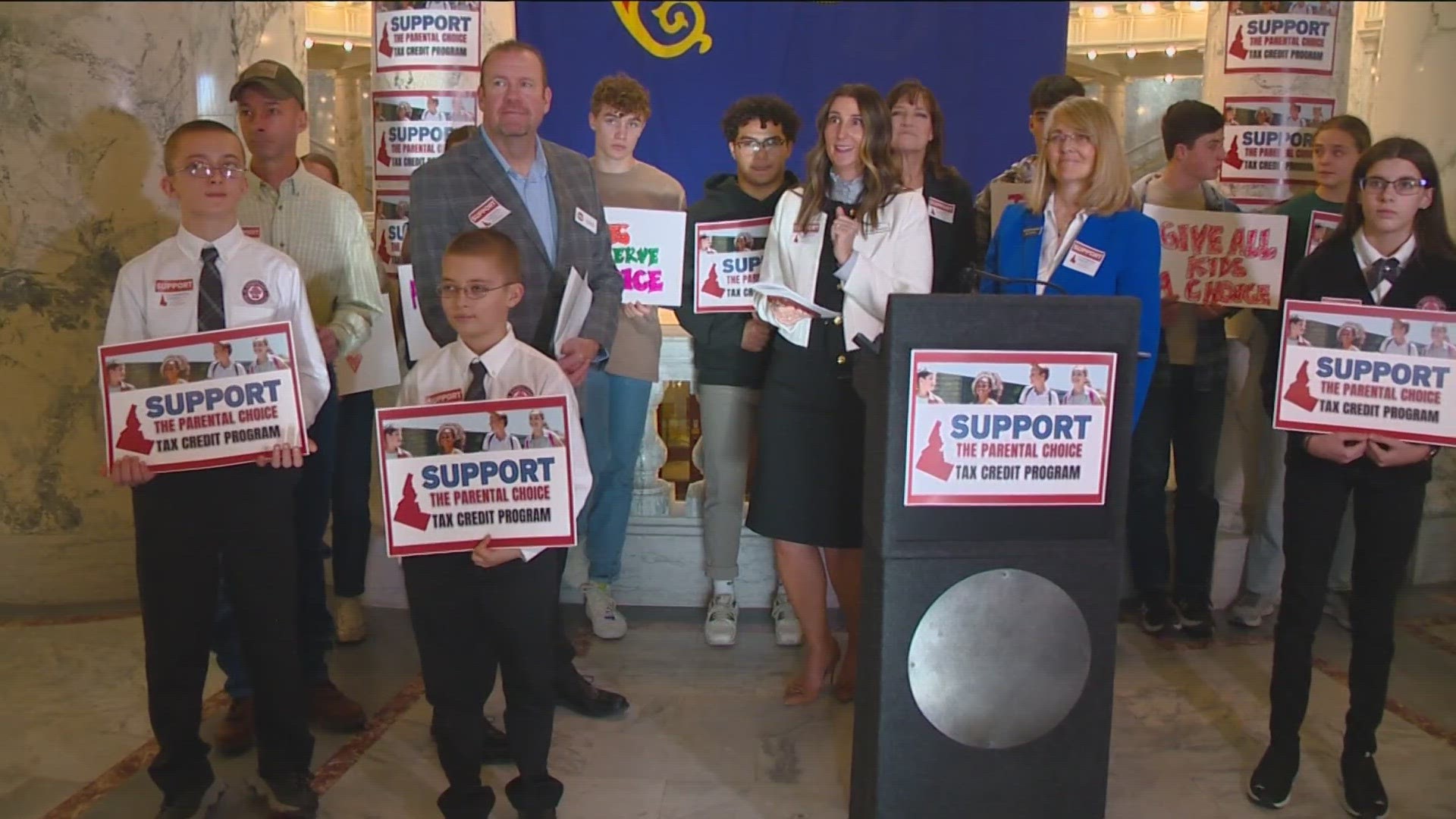

BOISE, Idaho — A group of republican lawmakers are heading into the legislative session with new school choice legislation — the Parental Choice Tax Credit program.

"We're very hopeful this year," Sen. Lori Den Hartog, R-Meridian, said. "We learned a lot last session."

She said failed legislation from the previous session focused on education savings accounts, which would have created a pot of money for families to use on different education expenses.

If the new legislation passes, Den Hartog said eligible families could get up to $5,000 back per kid in their state taxes.

Den Hartog said the amount would depend on how much they spend on education, including tuition for a private school or homeschool program, tutoring, and transportation costs.

The goal is to help parents send their kids to whatever school they want regardless of where they live, she said.

"I think this is an opportunity for families that maybe have been interested in making a choice and just haven't been able to have the resources to do that upfront," Den Hartog said.

Single dad Robbe Hart supports the proposal. Hart said right now, he drives 62 miles roundtrip to get his two boys to their private school.

"The classical education is something that really benefits them," he said. "This bill, if it passes, would give us the opportunity to take some of that burden off of paying tuition and gas and all the different things that we have to go through."

Den Hartog said the tax credit would be capped at $40 million. Another $10 million would be set aside for a grant program helping low-income families that qualify for the federal-earned tax credit.

"Those families would be in that program for one year and then roll into the refundable tax credit portion in the second year," Den Hartog said.

Rep. Lauren Necochea (D-Boise) opposes the proposal. She does not think the $50 million is a good use of money.

"The tax credit is small in comparison to the full cost of tuition," she said. "And so, all we're going to be doing is subsidizing tuition for families who already decided to make that choice."

Necochea said Idahoans already have plenty of school choice and believes vouchers are "deeply unpopular among voters" because they take money away from public schools — a claim Rep. Wendy Horman, R-Idaho Falls, refuted during Friday's news conference.

"This is complementary and not competitive to public schools in funding or in any other way, in our opinion," she said.

Den Hartog said the Idaho State Tax Commission would oversee the programs. The legislative session kicks off Monday.

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist:

HERE ARE MORE WAYS TO GET NEWS FROM KTVB:

Download the KTVB News Mobile App

Apple iOS: Click here to download

Google Play: Click here to download

Watch news reports for FREE on YouTube: KTVB YouTube channel

Stream Live for FREE on ROKU: Add the channel from the ROKU store or by searching 'KTVB'.

Stream Live for FREE on FIRE TV: Search ‘KTVB’ and click ‘Get’ to download.