Idaho school bond and levy elections March 14

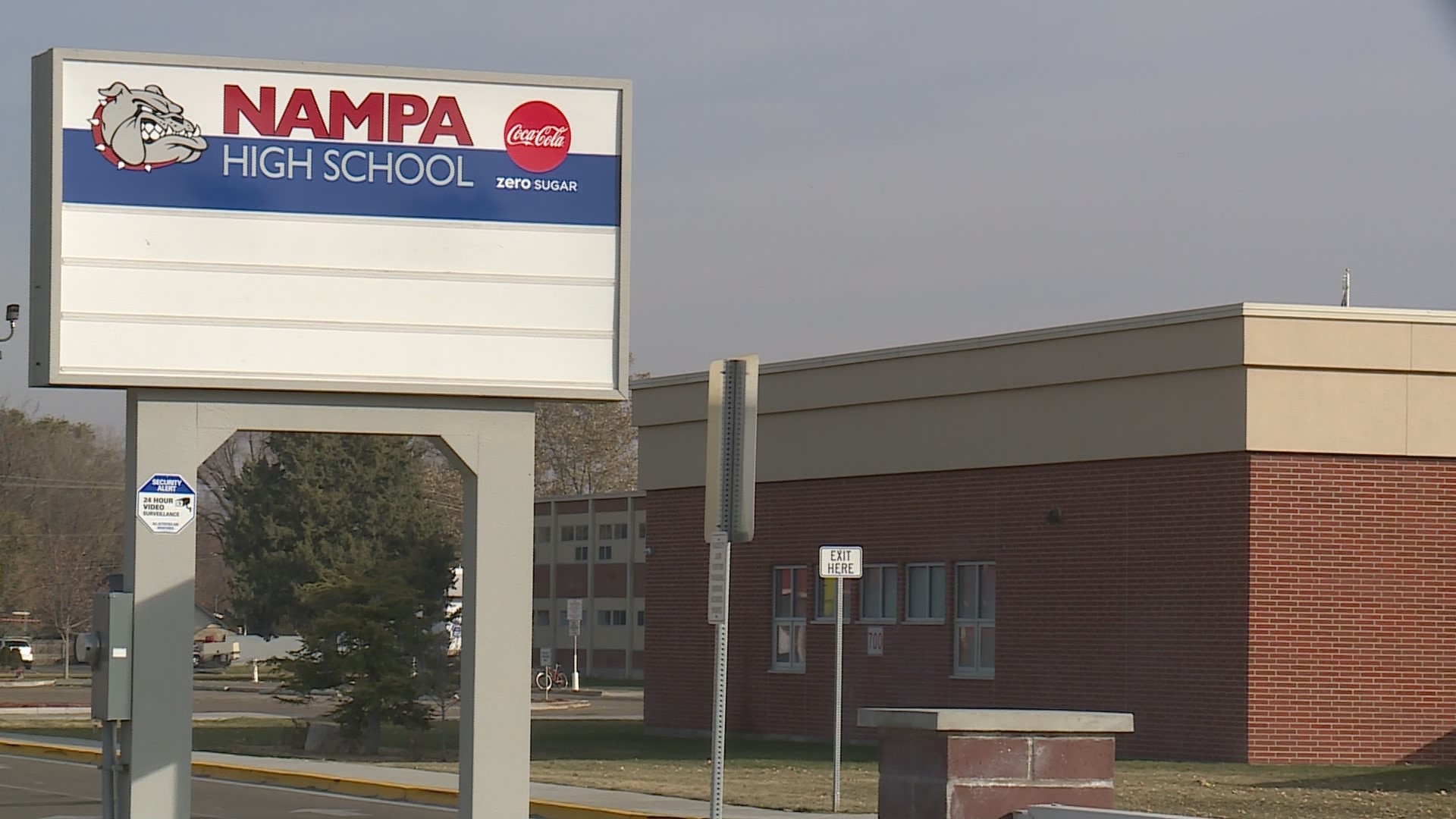

Kuna and Nampa are two of the school districts with major bond measures on the ballot in the upcoming election.

March 14 is the first of four election days on the 2023 Idaho Consolidated Election Calendar, and dozens of school districts around Idaho have bonds or levies, or both, on the ballot.

Bonds require a two-thirds supermajority – 66.67% voting “yes” or “in favor” – to pass. Plant facilities levies require 55% of the vote. Supplemental levies require a simple majority, 50% plus one.

There are no statewide issues on the March 14 ballot, only bonds or levies submitted individually by local school boards. Counties and school districts in southwest and south-central Idaho submitting measures to voters are listed below and in the chapters at the top of this story.

Update: The West Ada School District Board of Trustees voted Feb. 27 to put a plant facilities levy up for a vote. The election for that measure will take place on May 16.

Dates to remember Registration, early voting, absentee ballots

Information about registering to vote, checking your registration status, and finding your polling place is available at the Idaho Secretary of State’s official Vote Idaho website. The last day to register to vote online is Friday, Feb. 17. After that, you may register at early in-person voting or on Election Day at your polling place.

Voters wanting to vote by absentee ballot must submit an application to the county clerk's office by 5 p.m. Friday, March 3. That's the time the clerk's office must receive the application. Those who cannot be present for voting on Election Day due to hospitalization that began after the deadline may apply for an emergency absentee ballot between March 9 and 5 p.m. on March 13.

Early in-person voting is available Feb. 27 through March 10, 8 a.m. to 5 p.m. Monday through Friday, in counties that offer it.

Ada County Kuna School District

Kuna Joint School District Bond (District includes parts of Ada and Canyon counties; 66.67% needed for approval)

- Purpose: Financing construction of a new elementary school; renovations and additions to Kuna Middle School and Fremont Middle School; construction of an additional classroom wing and athletic additions to Swan Falls High School; construction of an additional bus facility; and various maintenance projects throughout the district.

- Amount/term: Principal amount not to exceed $111,445,000; term of 27 years or less; estimated total of $183,380,200 based on anticipated interest rate of 4.06% per annum.

- Estimated average annual cost to the taxpayer: $128 per $100,000 of taxable assessed value, per year, based on current conditions. The district’s existing bond levy is expected to decrease by $128 per $100,000. “Therefore, if the proposed bonds are approved, the estimated average annual cost to the taxpayer is not expected to increase based on current conditions.”

Adams County Meadows Valley S.D.

Meadows Valley School District Supplemental Levy

- Amount: $337,400 per year for two years

- Purposes: $140,000 for salary and benefits to retain two teaching staff positions; $58,000 for business and computer class instruction; $50,000 for curriculum, supplies and equipment; $50,000 for weight room remodel, staffing and equipment; $24,000 for signage at City Park and sports field improvements; $25,000 for technology devices, maintenance and software; $12,400 for playground improvements and safety; $10,000 for athletic programs transportation; $4,000 for assistance to office staff

- Estimated average annual cost to the taxpayer: $55.60 per $100,000 of taxable assessed value, per year, based on current conditions

Boise County Horseshoe Bend S.D.

Horseshoe Bend School District Supplemental Levy

- Amount: $300,000 per year for two years

- Purposes: $100,000 to maintain current staffing levels; $50,000 to maintain/improve buildings and facilities; $40,000 for student resource officer and other school safety measures; $25,000 for preschool program; $25,000 for athletics and other extracurricular activities; $25,000 for curriculum and materials for students; $20,000 for Community Schools Program; $15,000 for technology and technology upgrades.

- Estimated average annual cost to the taxpayer: $80 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy would replace an existing levy that will expire June 30, 2023 and currently costs $80 per $100,000 of taxable assessed value. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is not expected to change.

Camas County Camas County School District

Camas County School District Supplemental Levies

Question 1

- Amount: $225,000 per year for two years

- Purposes: $127,154 for salaries; $97,846 for supplies and materials for schools of the district

- Estimated average annual cost to the taxpayer: $100.39 per $100,000 of taxable assessed value, per year, based on current conditions

Question 2

- Amount: $75,000 per year for two years

- Purposes: Paying approximately $75,000 for salaries and benefits pertaining to the continuation of a fine arts program (music)

- Estimated average annual cost to the taxpayer: $33.46 per $100,000 of taxable assessed value per year, based on current conditions.

Canyon County Kuna bond, Nampa bond, Notus plant facilities levy, Parma COSSA levy

Kuna Joint School District Bond (District includes parts of Ada and Canyon counties; 66.67% needed for approval)

Purpose: Financing construction of a new elementary school; renovations and additions to Kuna Middle School and Fremont Middle School; construction of an additional classroom wing and athletic additions to Swan Falls High School; construction of an additional bus facility; and various maintenance projects throughout the district.

- Amount/term: Principal amount not to exceed $111,445,000; term of 27 years or less; estimated total of $183,380,200 based on anticipated interest rate of 4.06% per annum.

- Estimated average annual cost to the taxpayer: $128 per $100,000 of taxable assessed value, per year, based on current conditions. The district’s existing bond levy is expected to decrease by $128 per $100,000. “Therefore, if the proposed bonds are approved, the estimated average annual cost to the taxpayer is not expected to increase based on current conditions.”

Nampa School District General Obligation Bond (66.67% needed for approval)

- Purposes: Replacement of Nampa High School and Centennial Elementary School; construction of a new Career and Technical center; renovations and upgrades to athletic facilities, including tracks, tennis courts, stadiums and gymnasiums; renovations at Columbia High School, Skyview High School, West Middle School and Central Elementary; and safety and security projects throughout the District.

- Amount: $210.2 million principal to be repaid no later than 25 years from date of issuance; anticipated interest rate is 4% per annum; estimated total to be repaid is $283.16 million based on principal amount plus approximately $125.9 million in interest, less approximately $52.9 million in estimated bond levy equalization payments.

- Estimated average annual cost to the taxpayer: $85 per $100,000 of taxable assessed value, per year, based on current conditions. Currently, the District collects a bond levy in the amount of $60 per $100,000 of taxable assessed value per year that will expire before the proposed bonds are levied. If the proposed bonds are approved, the estimated average annual cost to the taxpayer is expected to increase by $25 per $100,000 of taxable assessed value, per year.

Notus School District Plant Facilities Levy (55% of vote needed for approval)

- Purposes: Remodel and repair of existing school facilities and construction of new school facilities.

- Amount: 10-year levy; $365,000 for fiscal year that begins July 1, 2023, and up to 0.2% of market value for assessment purposes per year for 10 years.

- Estimated average annual cost to the taxpayer: $121 per $100,000 of taxable assessed value, per year, based on current conditions. Currently, the District collects a plant facilities levy of $69 per $100,000 of taxable assessed value, which will expire June 30, 2023. Proposed school plant facilities levy is expected to result in an increase of $52 per $100,000 of taxable assessed value.

Parma School District COSSA Levy

- Purpose: To pay for Parma School District’s share of operating costs for Canyon Owyhee School Service Agency.

- Amount: Up to 0.1% of the school district’s market value. To be collected for a period of 10 years.

- Estimated average annual cost to the taxpayer: $100 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy would replace an existing levy of the same amount, which will expire June 30, 2023. Therefore, the estimated cost to the taxpayer is not expected to change.

Cassia County Cassia Joint S.D.

Cassia Joint School District School Plant Facilities Reserve Fund Levy (55% of vote needed for approval; includes parts of Cassia, Twin Falls and Oneida counties)

- This is a 10-year levy of up to $3.45 million per year, but in lesser amounts for years 1 through 6.

- The estimated average annual cost to the taxpayer on the proposed levy of $3,450,000 is a tax of $121.18 per $100,000 of taxable assessed value, per year, based on current conditions. The estimated average annual cost to the taxpayer on the proposed levy of $2,900,000 in Year 1 is a tax of $101.87 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that will expire on June 30, 2023, and that currently costs $64.98 per $100,000 of taxable assessed value. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is expected to increase by $36.89 per $100,000 of taxable assessed value in Year 1 and by $56.20 in years 7-10 based on current conditions.

Custer, Butte, Lemhi counties Butte County Joint S.D., Challis Joint S.D.

Butte County Joint School District Plant Facilities Reserve Fund Levy (District includes parts of Butte and Custer counties; 55% required for approval)

- Amount: $206,000 ($103,000 per year for two years)

- Purposes: Allowing the district to accumulate funds for and to build a school house, or school houses or other building or buildings; to demolish or remove school buildings; to add to, maintain, remodel or repair any existing lighting, heating, ventilation and sanitation facilities and appliances necessary to maintain and operate buildings of the district; to purchase school buses; to purchase equipment; for lease and lease purchase agreements for any of the above purchases and to repay loans from commercial lending institutions extended to pay for the construction of school plant facilities.

- Estimated average annual cost to the taxpayer: $45.92 per $100,000 of taxable assessed value, based on current conditions.

Butte County Joint School District Supplemental Levy

- Amount: $160,000 per year for two years

- Purposes: $90,000 for salaries and benefits for teachers and staff; $30,000 for maintenance and transportation; $20,000 for classroom supplies and curriculum; $20,000 for technology devices and software

- Estimated average annual cost to the taxpayer: $69 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that expires June 30, 2023, and currently costs $71.33 per $100,000 of taxable assessed value. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is not expected to increase.

Challis Joint School District Supplemental Levy (District includes parts of Custer and Lemhi counties)

- Amount: $700,000 per year for two years

- Purposes: $286,200 to supplement pay for classified support; $136,400 to supplement pay for certified instructional support; $100,000 to supplement pay for ancillary contracted support; $100,000 to pay coaches and other extracurricular activity advisors, bus drivers, and supplies; $54,400 to pay 15% of transportation cost; $23,000 to provide classroom resources and supplies.

- Estimated average annual cost to the taxpayer: $94.06 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that expires June 30, 2023, and currently costs $92.73 per $100,000 of taxable assessed value.

Gem County Emmett ISD

Emmett Independent School District Supplemental Levy

- Amount: $1.5 million per year for two years

- Purposes: $900,000 for personnel costs to include class-size reductions; $600,000 for district building safety upgrades and roof repair of Kenneth Carberry and Shadow Butte elementary schools

- Estimated average annual cost to taxpayer: $52 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that will expire June 30, 2023, and currently costs $35 per $100,000 of taxable assessed value. The proposed levy is expected to increase tax by $17 per $100,000 of taxable assessed value.

Gooding and Jerome counties Gooding Joint S.D.; Jerome Joint S.D.

Gooding Joint School District Supplemental Levy (District includes parts of Gooding and Lincoln counties; Lincoln County voters to receive ballots via mail)

- Amount: $759,000 per year for two years

- Purpose: Salaries and benefits for teachers and staff -- $510,500; School resource officers, safety and security -- $21,500; Classroom supplies and curriculum -- $68,000; Technology devices and software -- $64,500; Maintenance and transportation -- $94,500

- Estimated average annual cost to taxpayer: $86 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that expires on June 30, 2023 and currently costs $74 per $100,000 of taxable assessed value. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is expected to increase by $12.

Jerome Joint School District Supplemental Levy (Jerome and Gooding counties)

- Amount: $1.25 million per year for two years

- Purposes: $350,000 for non-reimbursed student transportation; $200,000 for a portion of program and software licenses; $700,000 a portion of salaries and benefits for classified staff and extracurricular staff

- Estimated average annual cost to taxpayer: $58 per $100,000 of taxable assessed value, per year, for two years, based on current conditions.

Owyhee County Castleford Joint S.D.

Castleford Joint School District Bond (District includes parts of Owyhee and Twin Falls counties; 66.67% required for approval)

- Purpose: Constructing a small multipurpose/practice gym with three attached classrooms

- Amount/term: Principal amount not to exceed $6 million; term not to exceed 30 years. Interest rate on proposed bond issue is 4.39% per annum; total amount estimated to be repaid over the life of the bonds is about $9.1 million, consisting of $6 million in principal and about $4.9 million interest, totaling about $10.9 million, less about $1.795 million in estimated bond levy equalization payments.

- Estimated average annual cost to the taxpayer: $131 per $100,000 of taxable assessed value, per year, based on current conditions.

Payette County Payette Joint S.D.

Payette Joint School District Supplemental Levy (District also includes part of Washington County)

- Total amount: $1 million ($500,000 per year for two years)

- Purposes: $500,000 for curriculum; $200,000 to repair and upgrade existing track; $110,000 for compensation and benefits to retain teachers and staff; $100,000 for field maintenance equipment; $90,000 for building security.

- Estimated average annual cost to the taxpayer: $44.91 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that expires June 30, 2023, and currently costs $35.93 per $100,000 of taxable assessed value. If the proposed levy is approved, tax is expected to increase by $8.98 per $100,000 of taxable assessed value.

Twin Falls County Cassia, Castleford, Hansen, Twin Falls school districts

Cassia Joint School District School Plant Facilities Reserve Fund Levy (55% of vote needed for approval; includes parts of Cassia, Twin Falls and Oneida counties)

- This is a 10-year levy of up to $3.45 million per year, but in lesser amounts for years 1 through 6.

- The estimated average annual cost to the taxpayer on the proposed levy of $3,450,000 is a tax of $121.18 per $100,000 of taxable assessed value, per year, based on current conditions. The estimated average annual cost to the taxpayer on the proposed levy of $2,900,000 in Year 1 is a tax of $101.87 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that will expire on June 30, 2023, and that currently costs $64.98 per $100,000 of taxable assessed value. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is expected to increase by $36.89 per $100,000 of taxable assessed value in Year 1 and by $56.20 in years 7-10 based on current conditions.

Castleford Joint School District Bond (66.67% (2/3) required for approval) (also includes Owyhee County)

- Purpose: Constructing a small multipurpose/practice gym with three attached classrooms

- Amount/term: Principal amount not to exceed $6 million; term not to exceed 30 years. Interest rate on proposed bond issue is 4.39% per annum; total amount estimated to be repaid over the life of the bonds is about $9.1 million, consisting of $6 million in principal and about $4.9 million interest, totaling about $10.9 million, less about $1.795 million in estimated bond levy equalization payments.

- Estimated average annual cost to the taxpayer: $131 per $100,000 of taxable assessed value, per year, based on current conditions.

Hansen School District Supplemental Levy

- Amount: $290,000 per year for two years

- Purposes: $167,000 per year for salaries and benefits for teachers, coaches and support staff; $60,000 for extracurricular services (field trips, athletic bussing); $50,000 for technology, textbooks and classroom materials (includes purchased services such as IDLA and website maintenance); $13,000 for preschool and after-school programs

- Estimated average annual cost to the taxpayer: $122.39 per $100,000 of taxable assessed value based on current conditions. The proposed levy replaces an existing levy that will expire on June 30, 2023, and that currently costs $167.11 per $100,000 of taxable assessed value. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is expected to decrease by $44.72.

Twin Falls School District Supplemental Levy

- Amount: $5.7 million per year for two years

- Purposes: $4 million for salaries and benefits for teachers and other staffing positions; $1.3 million for safety and security (school resource officers, elementary security guards, security/behavior aids, and other security needs); $400,000 for extracurricular activities (sports, drama, music, etc.)

- Estimated average annual cost to the taxpayer: $75 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that expires June 30, 2023, and currently costs the same as the proposed levy. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is not expected to change.

Valley County Cascade School District

Cascade School District Supplemental Levy

- Amount: $650,000 per year for two years

- Purposes: $500,000 for salaries and benefits for teachers and staff; $100,000 for maintenance, transportation and food service; $50,000 for school safety and security updates

- Estimated average annual cost to the taxpayer: $42.52 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that expires June 30, 2023, and currently costs $92.84 of taxable assessed value. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is expected to decrease.

Washington County Weiser and Payette school districts

Payette Joint School District Supplemental Levy (also includes Payette County)

- Total amount: $1 million ($500,000 per year for two years)

- Purposes: $500,000 for curriculum; $200,000 to repair and upgrade existing track; $110,000 for compensation and benefits to retain teachers and staff; $100,000 for field maintenance equipment; $90,000 for building security.

- Estimated average annual cost to the taxpayer: $44.91 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that expires June 30, 2023, and currently costs $35.93 per $100,000 of taxable assessed value. If the proposed levy is approved, tax is expected to increase by $8.98 per $100,000 of taxable assessed value.

Weiser School District Plant Facilities Reserve Fund Levy (55% required for approval)

- Amount: Up to $500,000 per year for four years.

- Estimated average annual cost to the taxpayer: $59.44 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that expires June 30, 2023, and currently costs $36.85 per $100,000 of taxable assessed value. If the proposed levy is approved, the tax is expected to increase.

Watch more Idaho politics:

See all of our latest political coverage in our YouTube playlist:

Download the KTVB mobile app to get breaking news, weather and important stories at your fingertips.