Idaho local elections May 16, 2023: What's on the ballot

A big levy for the West Ada School District, library board seats, and Cascade fire and hospital funding are some of the issues up for a vote.

A proposed levy to raise funds for school construction and maintenance in Idaho's largest school district, the West Ada School District, is just one of the local issues up for a vote in the upcoming May 16 election.

More information about what's on the ballot in southwest and south-central Idaho is posted for each county below, and can be accessed by clicking one of the chapter links at the top of this story.

Some counties, or parts of counties, are not participating in this election. In Ada County, you can plug in your address to find out what's on your ballot — or if there's anything to vote on at all.

What voters throughout Idaho need to know

Friday, April 21, is the last day to register to vote using the state’s online registration system. After that, Idaho residents may register at a polling place on Election Day or at an in-person early voting location.

Absentee ballots may be requested through May 5, but only if you have registered or updated your registration by April 21.

In-person early voting is open May 1-12, Monday-Friday, 8 a.m. to 5 p.m., in the counties offering that option.

Under Idaho law, voters are required to show photo identification. If a voter is registered but not able to show an acceptable ID, the voter may sign a personal identification affidavit instead, swearing their stated identity is true under penalty of perjury. More information about identification requirements is available here.

More questions? Ask your county clerk. Go here for contact information for elections clerks in all 44 of Idaho's counties.

Ada County Kuna and Meridian library boards, West Ada S.D.

Ada County Free Library District Trustee

Four-year term

- Sandra Taylor

- Deborah A. Pogue

Six-year term

- Melodie C. Huttash

- Renee L. Trommler

- Mary Anne Saunders

Kuna Library District Trustee

Six-year term (vote for one)

- Teresa Haldorson

- Barb Powell

Meridian Library Trustee

4-year term (Vote for one)

- Josh Cummings

- David J. Tizekker

6-year term (Vote for one)

- Destinie Hart

- Xavier Torres

West Ada School District

Plant Facilities Reserve Levy – requires 55% voting in favor to pass

Amount: Up to $50 million for Fiscal Year beginning July 1, 2023, and continuing each year in the amount of up to $50 million for 10 years through the fiscal year ending June 30, 2033.

Estimated average annual cost to the taxpayer: $89.45 per $100,000 of taxable assessed value, per year, based on current conditions.

West Boise Sewer and Water District

Six-year term

- Trevor Taylor

- Roy R. Kay

Eagle Sewer and Water District

Two positions for two six-year terms

- Terry Loftus

- Tillie Reed

- Steve Bender

Star Sewer and Water District

Six-year term

- Greg Timinsky

Greater Boise Auditorium District

Two positions, both for two six-year terms

- Kristin Muchow

- Tiam Rastegar

Boise Warm Springs Water District

Six-year term, vote for one

- Scott Peterson

- Mary K. Aucutt

Adams County Salmon River School District

Salmon River School District

Supplemental Levy – requires simple majority (more than 50%) voting in favor to pass

Amount: $495,000 for one year (for fiscal year beginning July 1, 2023)

Purpose: “Supplementing payment of all lawful expenses of maintaining and operating the schools of the District;” The uses and approximate amount of levy funds to be allocated to each use are as follows:

- Teacher salaries: $120,000

- Classified staff: $80,000

- Additional special education teacher and aides: $140,000

- Extracurricular services and tech: $155,000

Estimated average annual cost to the taxpayer: $172.52 per $100,000 of December taxable assessed values based on the current conditions.

Blaine County Hailey, Ketchum, Sun Valley

City of Hailey

Special municipal revenue bond – wastewater system

Purpose: Financing the design, acquisition and construction of certain improvements to the City of Hailey’s wastewater treatment system and facilities. Improvements to be financed by the sale of the proposed bonds include construction, repair, replacement and rehabilitation of the City’s wastewater treatment system due to its deterioration over time, including replacement of the system’s Headworks facility and other improvements and betterments to the system required to ensure the safe and continued operation of the system.

Amount: Up to $6 million (principal) to be repaid over 20 years. The total amount estimated to be repaid over the life of the bonds, based on the anticipated interest rate of 4.56% per annum, is approximately $10.9 million.

Estimated average annual cost to the taxpayer: None. The bonds will be repaid from the revenues of the city’s wastewater system.

Special non-property tax election – Modifying purpose of hotel/motel and rental car sales tax

Question: Shall the City of Hailey adopt Hailey Ordinance No. 1319?

The ordinance modifies the purpose of the 1% tax imposed and collected on the total amount charged for rental use or temporary occupancy of a room and/or the living unit in a hotel or motel and the 1% tax on the total amount charged for rental use of a rental vehicle, by dividing same and applying 0.5% as follows:

- Maintaining and increasing commercial air service to Friedman Memorial Airport through the use of Minimum Revenue Guarantees or other inducements to providers

- Promoting and marketing the existing service and any future service to increase passengers

- For all ancillary costs associated with the ongoing effort to maintain and increase commercial air service, including reasonable program management costs and busing due to flight diversion(s)

- Direct costs to collect and enforce the tax, including administrative and legal fees

In the event the Joint Powers Agreement is dissolved, under the authority of which the Sun Valley Air Service Board exists and is authorized to spend 0.5% of the non-property taxes collected from the Rental Vehicle and Hotel-Motel Occupancy Taxes, and the non-property tax of 0.5% collected until such time for air services shall continue to be collected and shall be spent for the general purposes of the tax described in Hailey Code Section 5.32.50.A.(1)-(8).

And applying 0.5% as follows:

- Developing community housing for families living and working in Hailey

- For all ancillary costs associated with the ongoing effort to develop community housing for families living and working in Hailey

- Direct costs to collect and enforce the tax, including administrative and legal fees

All other aspects of the certain local option non-property tax approved by the voters in May of 2020 as Ordinance 1257, the definitions and specific tax approved therein, the exact purpose or purposes thereof for which the revenues would be used, and the duration and term of same, will remain unchanged.

City of Ketchum

1% Local Option Tax modification

Question: “Shall the City of Ketchum adopt Ordinance No. 1244 amending previously voter-approved Ordinance 1166, which provides for the collection of a 1% local non-property tax to maintain and increase commercial air service to Friedman Memorial Airport through promotion and minimum revenue guarantees? There is no proposed increase in existing local-option taxes.”

Ordinance No. 1244 proposes the following changes:

- Extension of existing 1% local option non-property tax for a period of five years from its effective date of July 1, 2023

- Half of the one percent to be allocated for the ongoing purpose of preservation and support of air service

- Half of the one percent to be allocated solely for the purpose of preservation and creation of community housing

“This is an extension of the existing one percent local-option tax with a modified allocation of purposes. There is no proposed increase in existing local-option taxes.”

City of Sun Valley

0.5% Local Option Tax for Air

Question: “Shall the City of Sun Valley adopt Ordinance 572 amending the previously voter-approved 1% local non-property tax designated to the purpose of maintaining and increasing commercial air service to Friedman Memorial Airport? The local option tax designated for supporting air service would be reduced to 0.5% and extended for five years.”

Ordinance No. 572 proposes the following changes:

- Replacing the existing local-option tax with a 0.5% local-option non-property tax for air for a period of five years from July 1, 2023

- Designating this 0.5% local-option tax for the purpose of supporting commercial air services

“There is no proposed increase in existing local-option taxes.”

Camas County Cemetery levy

Camas County Cemetery District

Temporary override of property tax levy

Question: “Shall the Camas County Cemetery District be authorized to temporarily override the current property tax levy in accordance with Idaho code 63-802?”

Purpose: To improve, develop, maintain and operate the district’s four cemeteries, as well as organize, computerize and maintain all documents and records.

Total requested amount: $28,574 per year for two years. The current tax levy is $4,757 per year.

Estimated annual cost to the taxpayer: “The override levy would add approximately $11.55 per $100,000 of assessed value per year.” The current property tax levy is $1.92 per $100,000 of assessed value per year.

Canyon County Parma, Vallivue, West Ada schools; Golden Gate Highway; Kuna library board

Parma School District

Two-year supplemental levy – requires simple majority (at least 50%) voting in favor to pass

Amount: $400,000 per year for a period of two years, commencing with the fiscal year that begins July 1, 2023

Purpose: Paying all lawful expenses for maintaining and operating the schools of the District. The purposes and approximate amount of levy funds to be allocated to each use are as follows:

- Classified salaries and benefits: $116,000 in first year of levy; $119,480 in second year

- Certified salaries and benefits: $149,000 in first year; $152,000 in second year

- Extracurricular coaching stipends: $51,000 each year for both years

- Extracurricular services (non-reimbursable field trips, athletic bussing, driver salaries): $16,000 each year for both years

- Technology (flat-panel screens, software licenses, upgrades, etc.): $19,000 for first year; $12,520 for second year

- School resource officer: $49,000 each year for both years

Estimated average annual cost to the taxpayer: $46.72 per $100,000 of taxable assessed value, per year, based on current conditions. According to the statement on the ballot, there would be a tax rate decrease with this approval compared to the last supplemental levy.

Vallivue School District

Special general obligation bond – requires 66.67% (2/3) voting in favor to pass

Amount: Up to $78 million (principal amount) to be repaid over 20 years. The total amount, including principal, plus nearly $38.7 million (based on anticipated rate of 3.77% per annum), less nearly $29.3 million in estimated bond levy equalization payments, is approximately $87.4 million.

Purpose: Finance costs of acquiring and building two new elementary schools; repairing, renovating, remodeling, equipping and furnishing other existing schools and facilities, including but not limited to new roofs and HVAC systems at Vallivue High School and East Canyon Elementary; and purchasing improved and unimproved land for future school sites and various school facilities.

Estimated average annual cost to the taxpayer: $47 per $100,000 of taxable assessed value, per year, based on current conditions. The District’s existing bond levy is expected to decrease by $47 per $100,000, so the estimated average annual cost to the taxpayer is not expected to increase.

West Ada School District

Plant Facilities Reserve Levy – requires 55% voting in favor to pass

Amount: Up to $50 million for Fiscal Year beginning July 1, 2023, and continuing each year in the amount of up to $50 million for 10 years through the fiscal year ending June 30, 2033.

Estimated average annual cost to the taxpayer: $89.45 per $100,000 of taxable assessed value, per year, based on current conditions.

Golden Gate Highway District

Commissioner Sub-District 3 (Vote for one)

- Bree Walker

- Fred Sarceda

Kuna Library District Trustee

Six-year term (vote for one)

- Teresa Haldorson

- Barb Powell

Cassia County Burley library levy, Burley Highway District

City of Burley

Library levy (combine Cassia County and Minidoka County results)

Amount: $350,000 per year for two years (tax years 2023 and 2024)

Purpose: To provide 61% of the general operating funds for the library and for an improved patron experience by using funds to make available access to member libraries, which share materials for the benefit of patrons. Levy funds shall also be used for software and equipment systems and the purchase of e-books, audio, and visual library materials. The funds shall also be used to pay for a program librarian, librarians and support staff salaries, and to provide service and maintenance, as well as fund contracted internet technical support and salaries for junior resource interns to help teach job skills.

Estimated average annual cost to the taxpayer: $21.88 per $100,000 of taxable assessed value, per year, based on current conditions.

Burley Highway District

Commissioner Sub-District 3

- Michael Glen Searle

- Gaylen Smyer

Elmore County Atlanta Highway District

Atlanta Highway District

Commissioner 1

- Darrell Coleman

- Jerry Hardy

Commissioner 3

- Gary M. Cram

Gem County Emmett School District

Supplemental levy 1

Purpose: Carberry and Shadow Butte elementary schools’ roof removal and replacement, building entry updates, lighting and security cameras, interior door ADA-compliant hardware, and other maintenance items of the District.

Amount: $600,000 per year for two years

Estimated average annual cost to the taxpayer: For proposed levy, $20.98 per $100,000 of taxable assessed value, per year, based on current conditions. The District has an existing levy that will expire June 30, 2023, and currently costs $35 per $100,000 of taxable assessed value.

Supplemental levy 2

Purpose: To support current staffing levels and provide additional support for special education and counseling.

Amount: $400,000 per year for two years

Estimated average annual cost to the taxpayer: For proposed levy, $13.99 per $100,000 of taxable assessed value, per year, based on current conditions. The District has an existing levy that will expire June 30, 2023, and currently costs $35 per $100,000 of taxable assessed value.

Gooding County Hagerman water bond; Hagerman school levy

City of Hagerman

Special revenue bond election – water system

Purpose: Improvements to the water system, to include an increase in water supplies, disinfection, storage, pumping, additional distribution lines, and controls. The City currently has outstanding long-term indebtedness of $2,224,424 paid solely from wastewater system revenues.

Amount: Not to exceed $4.8 million (principal) to be repaid over 40 years, solely from water system revenues. Anticipated interest rate on bonds is 2.75%. Total interest estimated to be paid over life of bonds is about $3.1 million.

Estimated average annual cost to the taxpayer: Since the bond will be paid solely from water revenues, there will be no property tax authorized on any taxable assessed value.

Hagerman School District (combine results for Gooding and Twin Falls counties)

Plant Facilities Reserve Fund Levy – 55% of vote in favor required for approval

Amount: Up to $400,000 per year for five years “for the purposes permitted by law for school plant facilities levies.”

Estimated average annual cost to the taxpayer: $102.42 per $100,000 of taxable assessed value, per year, based on current conditions. “If the proposed levy is approved, the tax per $100,000 of taxable assessed value is expected to remain unchanged.”

Idaho County Salmon River School District

Salmon River School District

Supplemental Levy – requires simple majority (more than 50%) voting in favor to pass

Amount: $495,000 for one year (for fiscal year beginning July 1, 2023)

Purpose: “Supplementing payment of all lawful expenses of maintaining and operating the schools of the District;” The uses and approximate amount of levy funds to be allocated to each use are as follows:

- Teacher salaries: $120,000

- Classified staff: $80,000

- Additional special education teacher and aides: $140,000

- Extracurricular services and tech: $155,000

Estimated average annual cost to the taxpayer: $172.52 per $100,000 of December taxable assessed values based on the current conditions.

Lincoln County Shoshone Highway District

Shoshone Highway District #2

Zone 3 Commissioner

Anthony Owens

Mark R. Kime

Minidoka County Burley library levy

City of Burley

Library levy

Amount: $350,000 per year for two years (tax years 2023 and 2024)

Purpose: To provide 61% of the general operating funds for the library and for an improved patron experience by using funds to make available access to member libraries, which share materials for the benefit of patrons. Levy funds shall also be used for software and equipment systems and the purchase of e-books, audio, and visual library materials. The funds shall also be used to pay for a program librarian, librarians and support staff salaries, and to provide service and maintenance, as well as fund contracted internet technical support and salaries for junior resource interns to help teach job skills.

Estimated average annual cost to the taxpayer: $21.88 per $100,000 of taxable assessed value, per year, based on current conditions.

Owyhee County Homedale Highway District

Sub-district 1

- Eric Kushlan

- Andrew Eubanks

- Dennis W. Uria

Payette County Joint School District 371J levy

Joint School District 371J, Payette and Washington counties

Supplemental levy

Purposes: Curriculum for K-5 ELA, grades 6-8 science, grades 6-8 social studies, and other as approved by the trustees ($500,000); repair and upgrade existing track ($200,000); compensation and benefits to retain teachers and staff ($110,000); field maintenance equipment ($100,000); building security ($90,000).

Total amount: $1 million ($500,000 per year for two years)

Estimated average annual cost to the taxpayer: $44.91 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that expires on June 30, 2023, and that currently costs $35.93 per $100,000 of taxable assessed value. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is expected to increase by $8.98.

Twin Falls County Hagerman school levy

Hagerman School District

Plant Facilities Reserve Fund Levy – 55% of vote in favor required for approval

Amount: Up to $400,000 per year for five years “for the purposes permitted by law for school plant facilities levies.”

Estimated average annual cost to the taxpayer: $102.42 per $100,000 of taxable assessed value, per year, based on current conditions. “If the proposed levy is approved, the tax per $100,000 of taxable assessed value is expected to remain unchanged.”

Valley County Cascade hospital bond, Cascade fire levy

Cascade Hospital District

Special Bond Election – 2/3 supermajority (66.67%) in favor required for approval

Purpose: To pay the cost of constructing a district hospital.

Amount/term: Up to $40 million over 30 years; anticipated interest rate is 3% per annum. Total amount to be repaid over the life of the bonds is $60.77 million (principal plus interest).

Estimated average annual cost to the taxpayer: $93.05 per $100,000 of taxable assessed value, per year, based on current conditions.

Cascade Rural Fire District

Special Tax Levy – 2/3 supermajority (66.67%) in favor required for approval

Purpose: To defray the costs of staffing, hiring additional firefighter/EMTs, equipping and maintaining the Fire District’s operations, purchasing additional apparatus and facilities to protect property against fire and to provide life preservation services commencing with the Fiscal Year 2024, and which shall then be established as the base budget for the purposes of Idaho Code 63-802.

Amount: $650,000 per year

Estimated average annual cost to the taxpayer: $51.94 per $100,000 of taxable assessed value, per year, based upon current conditions.

Washington County Weiser school facilities levy, Joint School District 371J supplemental levy

Weiser School District

Plant Facilities Reserve Fund Levy Election — 55% of vote in favor required to pass

Question: Shall the Board of Trustees of the Weiser School District be authorized and empowered, upon the affirmative vote of 55% of the electors of the District voting in the election, to levy a School Plant Facilities Reserve Fund Levy in the amount of up to $310,000 for four years through fiscal year ending June 30, 2027, for the purposes permitted by law for school plant facilities levies?

Estimated average annual cost to the taxpayer: $36.85 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that will expire June 30, 2023, and currently costs $36.85 per $100,000 of taxable assessed value. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is not expected to change.

Joint School District 371J, Payette and Washington counties

Supplemental levy

Purposes: Curriculum for K-5 ELA, grades 6-8 science, grades 6-8 social studies, and other as approved by the trustees ($500,000); repair and upgrade existing track ($200,000); compensation and benefits to retain teachers and staff ($110,000); field maintenance equipment ($100,000); building security ($90,000).

Total amount: $1 million ($500,000 per year for two years)

Estimated average annual cost to the taxpayer: $44.91 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy replaces an existing levy that expires on June 30, 2023, and that currently costs $35.93 per $100,000 of taxable assessed value. If the proposed levy is approved, the tax per $100,000 of taxable assessed value is expected to increase by $8.98.

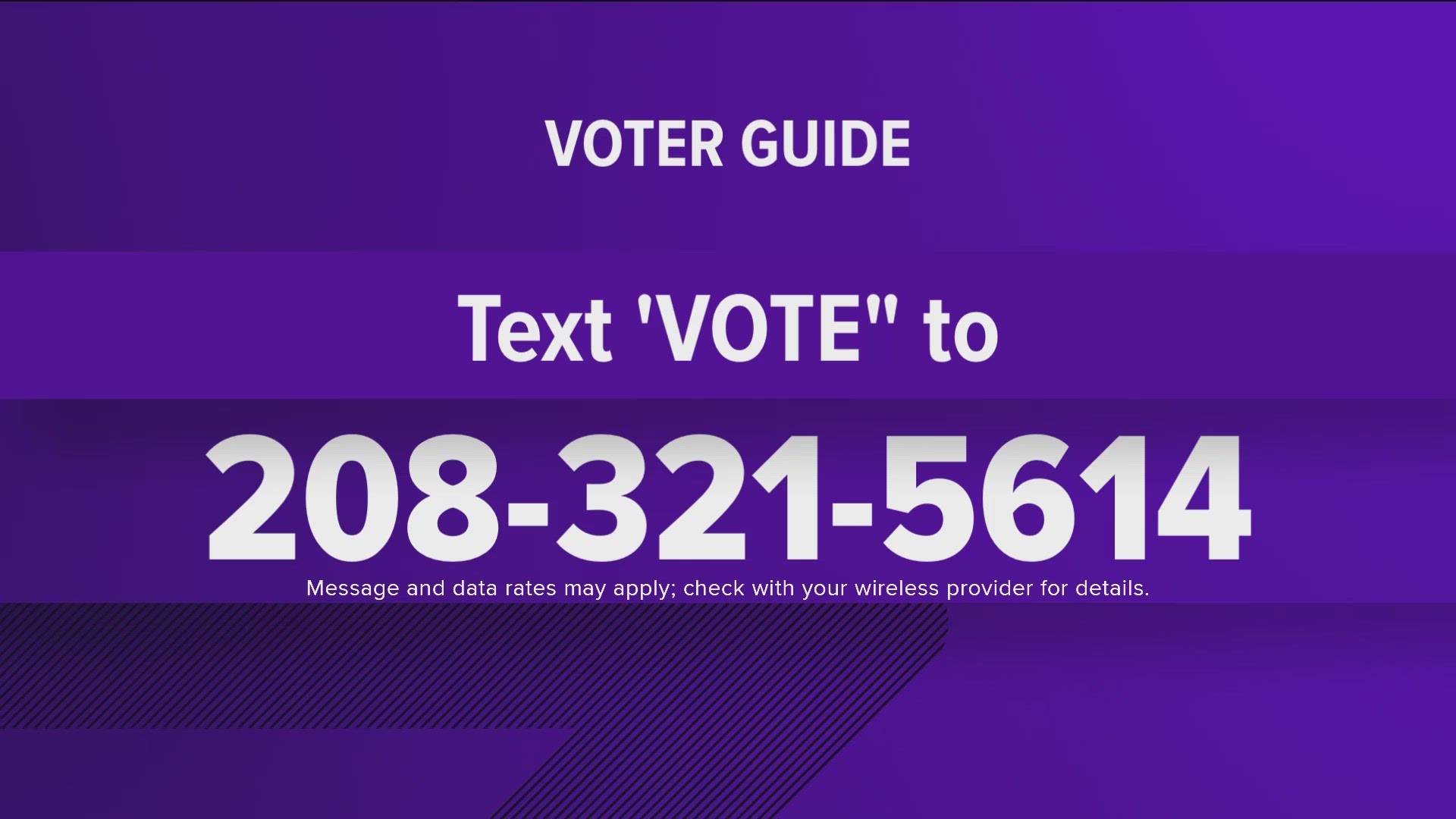

Polls will be open 8 a.m. to 8 p.m. on Tuesday, May 16. After the polls close, check in with KTVB.COM and Idaho's News Channel 7 as election results come in.

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist:

Download the KTVB mobile app to get breaking news, weather and important stories at your fingertips.