May 2020 Primary: County-by-county ballot breakdown

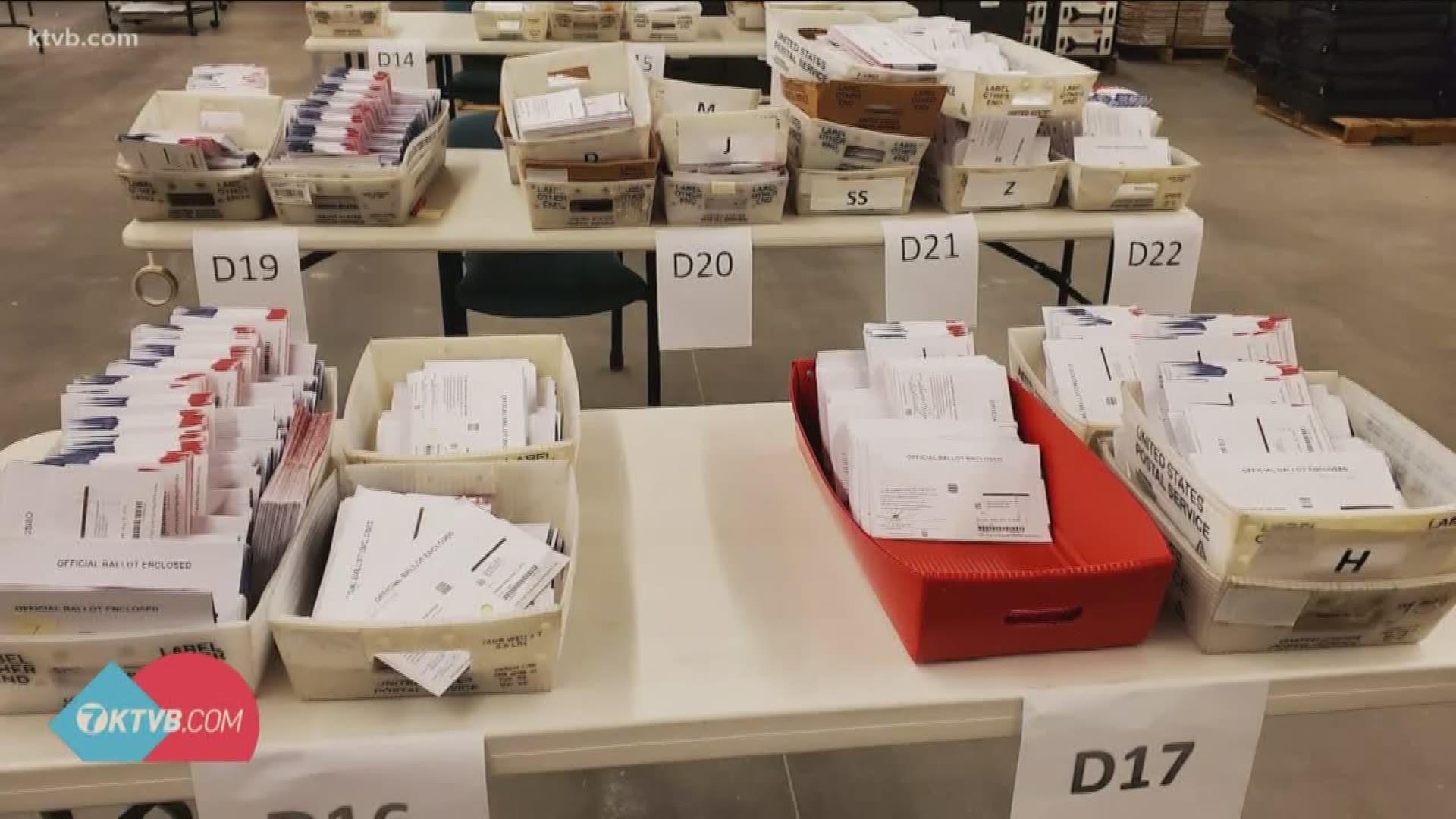

Find everything you need to know about Idaho's mail-in-only primary election on May 19.

On May 19, Idaho voters were set to decide county, legislative and congressional races, as well as ballot questions, including school funding requests.

Due to the coronavirus pandemic, the May 19 consolidated election became a mail-in-only primary, so you will have to request a ballot, which will reflect candidates from your party of choice. You can request an absentee ballot here, or by contacting your local county clerk. Voters had to request ballots by May 19. All ballots must be received at county clerks' offices by June 2.

Election results will be made available after 9 p.m. Mountain Time on June 2. KTVB will have full election coverage online and on the News at 10 that night.

This election is a primary, so your ballot will reflect candidates from your party of choice. The Republican and Constitution parties both have closed primaries, meaning only voters affiliated with those parties can vote for their respective candidates. The Democratic Party is holding an open primary, and anyone can vote for that party's candidates, so long as they have not voted on another party's ballot.

Below is a county-by-county breakdown, including legislative races in each county. You can look up your legislative district here.

All of Idaho's congressional, statewide and legislative races, can be found here.

You can also find a wealth of handy links - including voter registration information, absentee ballot request forms, and more - on our Voter Resources page.

TIP: If viewing on desktop or mobile web, you can jump to your county by clicking on the "Chapters" tab.

Ada County

Legislative District 14

State Senator

- REP C. Scott Grow

- REP Ted Hill

State Representative, Position A

- REP Mike Moyle

State Representative, Position B

- DEM Shelley Brock

- REP Gayann DeMordaunt

- REP Josh Tanner

Legislative District 15

State Senator

- DEM Rick Just

- REP Sarah A Clendenon

- REP Fred S. Martin

- REP Bill Zimmerman

State Representative, Position A

- CON David W. Hartigan

- DEM Steve Berch

- REP Patrick E. McDonald

State Representative, Position B

- DEM Jake Ellis

- REP Codi Galloway

Legislative District 16

State Senator

- DEM Grant Burgoyne

- REP LeeJoe Lay

State Representative, Position A

- DEM John McCrostie

State Representative, Position B

- DEM Nancy Harris (Withdrawn 03/24/2020)

- DEM Colin Nash

- DEM Geoff Stephenson

- REP Jacquelyn (Jackie) Davidson

Legislative District 17

State Senator

- DEM Adriel Martinez

- DEM Ali Rabe

- REP Gary L. Smith

State Representative, Position A

- DEM John Gannon

- REP Brittany Love

State Representative, Position B

- DEM Sue Chew

- REP Anthony T. Dephue

Legislative District 18

State Senator

- DEM Janie Ward-Engelking

- REP Mark A. Bost

- REP Joseph R. Crowell

- REP Hilary Lee

State Representative, Position A

- DEM Ilana Rubel

- REP Gary M. Childe

State Representative, Position B

- DEM Brooke Green

- REP Pete Thomas

Legislative District 19

State Senator

- DEM Melissa Wintrow

- REP Aaron J. Tribble

State Representative, Position A

- DEM Lauren Necochea

- REP Jim Feederle

State Representative, Position B

- DEM Jeff Gabica

- DEM Chris Mathias

- DEM Charlene Y. Taylor

- REP James F. Jacobson

- REP Gary Parent II

Legislative District 20

State Senator

- REP Chuck Winder

State Representative, Position A

- CON Daniel S. Weston

- DEM Pat Soulliere

- REP Dawn Maglish

- REP Joe A. Palmer

State Representative, Position B

- DEM Samantha 'Sammy' Hager

- REP James Holtzclaw

Legislative District 21

State Senator

- DEM Dawn Pierce

- REP Regina Bayer

- REP Wendy L. Webb

State Representative, Position A

- DEM Donald Williamson

- REP Steven C. Harris

State Representative, Position B

- LIB Lisa Adams

- REP Greg Ferch

- REP Eli Hodson

- REP Megan Kiska

- REP Brenda Palmer

Legislative District 22

State Senator

- DEM Mik Lose

- REP Lori Den Hartog

State Representative, Position A

- DEM Diane Jensen

- REP Chris Bruce

- REP John Vander Woude

State Representative, Position B

- DEM Nina Turner

- REP Jason A. Monks

- REP Heidi Sorenson

County Offices

County Commissioner, First District

- DEM Diana Lachiondo

- REP Ryan Davidson

- REP Davidson L. Haworth

County Commissioner, Second District

- DEM Bill Rutherford

- REP Rod W. Beck

- REP Mary McFarland

- REP Teri Murrison

- REP Fred Rippee

- REP Kim J. Wickstrum

County Sheriff

- REP Steve Bartlett

- REP Lisa Marie

County Prosecutor

- DEM Ron J. Twilegar

- REP Jan Bennetts

Ballot Questions

Kuna Rural Fire District

- Special Tax Levy

- Budget increase of $1,200,000

Ballot question:

Shall the Board of Commissioners of the Kuna Rural Fire District be authorized and empowered to increase its levy and budget, pursuant to Idaho Code Section 63-802 (3), to defray its cost of staffing, equipping and maintaining the Fire District's Operations to protect property against fire and to provide life preservation services by increasing its budget in the amount of $1,200,000.00 (One million two hundred thousand and No/100 Dollars) for (2) two Fiscal Years commencing with the Fiscal Year 2020-2021 and ending with Fiscal Year 2021-2022, which is estimated to result in a tax of $166.90 per one hundred thousand dollars ($100,000.00) of taxable assessed value, per year, based on current conditions, as provided in the resolution of the Board of Commissioners of the Kuna Rural Fire District adopted on March 11, 2020?

West Ada School District

- Supplemental Levy

- $14,000,000

Ballot question:

Shall the Board of Trustees of Joint School District No. 2, Ada and Canyon Counties, State of Idaho, be authorized and empowered to levy a Supplemental Levy in the amount of fourteen million and no/ dollars ($14,000,000.00) per year for two (2) years, commencing with the fiscal year beginning July 1, 2020 and ending June 30, 2022, for the purpose of financing any lawful expenses of maintaining and operating the District; all as provided in the Resolution adopted by the Board of Trustees on February 11, 2020?

The estimated average annual cost to the taxpayer on the proposed levy is a tax of $52.60 per $100,000 of taxable assessed value, per year, based on current conditions.

Adams County

Legislative District 9

State Senator

- REP Abby Lee

State Representative, Position A

- REP Ryan Kerby

- REP Jim Smith

State Representative, Position B

- DEM Allen Schmid

- REP Judy Boyle

County Offices

County Commissioner, First District

- REP Joe Iveson

County Commissioner, Second District

- REP Mike E. Paradis

County Sheriff

- REP Ryan Zollman

County Prosecutor

- REP Christopher Boyd

Ballot Questions

Salmon River Joint School District (Idaho and Adams counties)

- Supplemental Levy

- $525,000 per year for one year

Ballot question:

Shall the Board of Trustees of Salmon River Joint School District #243, Idaho and Adams Counties, State of Idaho be authorized to levy a Supplemental Levy in the amount of ($525,000.00) per year for a period of one year commencing with the fiscal year beginning July 1, 2020, for the purpose of paying all lawful expenses of maintaining and operating the schools of the District as provided in the resolution of the Board of Trustees of Salmon River Joint School District #243 adopted on February 18, 2020.

The estimated average annual cost to the taxpayer on the proposed levy based on the data above is a tax of $3.81 per $1000.00 of taxable assessed values based on the current conditions.

Blaine County

Legislative District 26

State Senator

- DEM Michelle Stennett

- REP Eric Parker

State Representative, Position A

- DEM Muffy Davis

State Representative, Position B

- DEM Sally J Toone

- REP William K Thorpe

County Offices

County Commissioner, First District

- DEM Dick Fosbury

County Commissioner, Second District

- DEM Jacob Greenberg

County Sheriff

- DEM Steve Harkins

County Prosecutor

- Matthew Fredback

Ballot Questions

City of Hailey

- Request for extension of local option tax

Ballot question:

Shall the City of Hailey, Idaho adopt an extension to its local option tax with Hailey Ordinance No. 1257?

Ordinance No. 1257 provides for the imposition, implementation and collection of non-property taxes for a period of thirty (30) years from its effective date, at the rate of three percent (3%) on the rental of passenger vehicles and hotel-motel room occupancy, two percent (2%) on retail sale of liquor by-the-drink, wine and beer, and one percent (1%) on the retail sale of restaurant food?

The purposes for which the revenues derived from said taxes shall be used are:

(A) Emergency services (rapid response, life saving, traffic enforcement, training, staffing, equipment, vehicles, etc.).

(B) Maintenance, improvement and acquisition of parks.

(C) Road repair, transportation enhancements and snow removal.

(D) City promotion, visitor information, special events and economic development.

(E) Town improvements (library modernization, sidewalks, town square, etc.).

(F) Public transit and related improvements.

(G) Direct cost to administer and enforce this ordinance.

Ordinance No. 1257 also provides for the imposition and collection of, for a period of thirty (30) years from its effective date, certain local-option nonproperty taxes, as follows:

Additional one percent (1%) tax on the total amount charged for rental use or temporary occupancy of a room or living unit in a hotel or motel.

Additional one percent (1%) tax on the total amount charged for rental use of a rental vehicle.

The purposes for which the revenues derived from the one percent (1%) of each of said taxes shall be used, pursuant to a joint powers agreement, are as follows:

a) maintaining and increasing commercial air service to Friedman Memorial Airport through the use of Minimum Revenue Guarantees or other inducements to providers;

b) promoting and marketing the existing service and any future service to increase passengers;

c) for all ancillary costs which are associated with the ongoing effort to maintain and increase commercial air service, including reasonable program management costs and busing due to flight diversion(s); and

d) direct costs to collect and enforce the tax, including administrative and legal fees.

In the event the Joint Powers Agreement is dissolved, under the authority of which the Sun Valley Air Service Board exists and is authorized to spend one percent (1) of the nonproperty taxes collected from Rental Vehicle and Hotel-Motel Occupancy Taxes, the nonproperty tax of one percent (1%) collected until such time for air services shall continue to be collected and shall be spent for the general purposes of the tax described in A-G above.

Boise County

Legislative District 8

State Senator

- CON Kirsten Faith Richardson

- REP Marla Lawson

- REP Steven Thayn

State Representative, Position A

- REP Terry Gestrin

State Representative, Position B

- REP Dorothy Moon

- REP LaVerne Sessions

County Offices

County Commissioner, First District

- REP Kenny Everhart

- REP Roger B Jackson

- REP Rhonda Jalbert

- REP Steven Twilegar

County Commissioner, Second District

- REP Gary L Brown

- REP Robert Holmes

- REP Alan D Ward

- REP Jeff Wright

County Sheriff

- REP Gregory Keefer

- REP Dale E. Ortmann

- REP Scott Turner

- REP Lee Wilkinson

County Prosecutor

- REP Adam Strong

Camas County

Legislative District 26

State Senator

- DEM Michelle Stennett

- REP Eric Parker

State Representative, Position A

- DEM Muffy Davis

State Representative, Position B

- DEM Sally J Toone

- REP William K Thorpe

County Offices

County Commissioner, First District

- REP Galen Colter

County Commissioner, Second District

- REP Marshall Ralph

County Sheriff

- REP Dave Sanders

County Prosecutor

- Write-in only

Ballot Questions

Camas County Cemetery District

- Permanent Override Levy

- Increase levy to $33,331

Ballot question:

Shall the Camas County Cemetery District be authorized to permanently override the current property tax levy of .00002712 to .0002?

This would increase the amount the Cemetery District would receive from the property tax levy to $33,331 per year from the current $4,520 per year. The current levy cost to property owners is $2.71 per $100,000 of assessed property value. The new levy would raise the cost to property owners to $20 per year per $100,000 of assessed property value. The funds would be used to operate, maintain, and develop the four cemeteries in Camas County the Cemetery District is responsible to operate.

Canyon County

Legislative District 9

State Senator

- REP Abby Lee

State Representative, Position A

- REP Ryan Kerby

- REP Jim Smith

State Representative, Position B

- DEM Allen Schmid

- REP Judy Boyle

Legislative District 10

State Senator

- DEM Toni Ferro

- REP Jim Rice

- REP Christopher T. Trakel

State Representative, Position A

- DEM Rebecca Yamamoto Hanson

- REP Jarom Wagoner

- REP Julie Yamamoto

State Representative, Position B

- DEM Chelsea Gaona-Lincoln

- REP Greg Chaney

Legislative District 11

State Senator

- REP Scott R Brock

- REP Zach Brooks

- REP Patti Anne Lodge

State Representative, Position A

- DEM Jacob Lowder

- REP Scott Syme

- REP Mila Wood

State Representative, Position B

- DEM Edward Saval

- REP Kirk L Adams

- REP Tammy Nichols

Legislative District 12

State Senator

- DEM Chelle Gluch

- REP Todd Lakey

State Representative, Position A

- DEM Pat Day Hartwell

- REP Bruce D. Skaug

State Representative, Position B

- REP Machele Hamilton

- REP Rick D. Youngblood

Legislative District 13

State Senator

- DEM Melissa Sue Robinson

- REP Jeff C Agenbroad

State Representative, Position A

- DEM Jason Kutchma

- REP Brent J. Crane

State Representative, Position B

- LIB Jess S Smith

- REP Ben Adams

- REP Kim B. Keller

- REP Randy Jackson

- REP Kenny Wroten

County Offices

County Commissioner, First District

- REP John Hess

- REP Mike Pullin

- REP Leslie Van Beek

County Commissioner, Second District

- REP Brad Holton

- REP Loni Parry

- REP Keri K. Smith-Sigman

- REP Chuck Stadick

County Sheriff

- REP Kieran Donahue

- REP Mike Rock

- REP Nick Schlader

- REP Jeff Taggart

County Prosecutor

- REP Bryan F. Taylor

Ballot Questions

Kuna Rural Fire District

- Special Tax Levy

- Budget increase of $1,200,000

Ballot question:

Shall the Board of Commissioners of the Kuna Rural Fire District be authorized and empowered to increase its levy and budget, pursuant to Idaho Code Section 63-802 (3), to defray its cost of staffing, equipping and maintaining the Fire District's Operations to protect property against fire and to provide life preservation services by increasing its budget in the amount of $1,200,000.00 (One million two hundred thousand and No/100 Dollars) for (2) two Fiscal Years commencing with the Fiscal Year 2020-2021 and ending with Fiscal Year 2021-2022, which is estimated to result in a tax of $166.90 per one hundred thousand dollars ($100,000.00) of taxable assessed value, per year, based on current conditions, as provided in the resolution of the Board of Commissioners of the Kuna Rural Fire District adopted on March 11, 2020?

Middleton School District

- Supplemental Levy

- $1,500,000 per year for two years

Ballot question:

Shall the Board of Trustees of School District No. 134, Canyon County, State of Idaho, be authorized and empowered to levy a Supplemental Levy, as provided in Section 33-802(3), Idaho Code, in the amount of one million five hundred thousand dollars ($1,500,000) per year for two (2) years, commencing with the fiscal year beginning July 1, 2020 and ending June 30, 2022, for the purpose of financing any lawful expenses of maintaining and operating the District; all as provided in the Resolution adopted by the Board of Trustees on March 18, 2020?

The estimated average annual cost to the taxpayer on the proposed levy is a tax of $94 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy will replace the District's existing supplemental levy which currently costs $82 per $100,000, resulting in a net increase of $12 per $100,000 of assessed value per year. The District has a bond levy that currently costs $309 per $100,000 of taxable assessed value, which is expected to decline to $292 per $100,000 of taxable assessed value. Therefore, the proposed supplemental levy produces a decrease in the combined costs per $100,000 of taxable assessed value of $5.

West Ada School District

- Supplemental Levy

- $14,000,000

Ballot question:

Shall the Board of Trustees of Joint School District No. 2, Ada and Canyon Counties, State of Idaho, be authorized and empowered to levy a Supplemental Levy in the amount of fourteen million and no/ dollars ($14,000,000.00) per year for two (2) years, commencing with the fiscal year beginning July 1, 2020 and ending June 30, 2022, for the purpose of financing any lawful expenses of maintaining and operating the District; all as provided in the Resolution adopted by the Board of Trustees on February 11, 2020?

The estimated average annual cost to the taxpayer on the proposed levy is a tax of $52.60 per $100,000 of taxable assessed value, per year, based on current conditions.

City of Wilder

- Liquor sales request

Ballot question:

Shall the City of Wilder license the sale of liquor by the drink?

Cassia County

Legislative District 27

State Senator

- REP Kelly Arthur Anthon

State Representative, Position A

- REP Scott Bedke

State Representative, Position B

- REP Fred Wood

County Offices

County Commissioner, First District

- REP Leonard M. Beck

County Commissioner, Second District

- REP Jim Powell

- REP Robert J Kunau

County Sheriff

- REP George Warrell

County Prosecutor

- REP Douglas G. Abenroth

Ballot Questions

ACE Fire Protection District

- Request to organize taxing district

Ballot question:

Shall the proposed ACE Fire Protection District be organized as a taxing district within the boundaries as fixed and more fully described in the Order Granting Petition and Fixing Boundaries of Proposed Taxing District, adopted by the Board of Commissioners for Cassia County, Idaho, on March 9, 2020?

City of Burley

- Street levy

- $165,000 per year for two years

- To be used for continued construction, repair, and maintenance of Burley city streets

Ballot question:

Shall the levy upon the taxable property within the City of Burley be increased to produce the sum of one hundred sixty-five thousand and no/100 dollars ($165,000.00) in excess of that otherwise allowed by law, for each of the tax years 2020 and 2021, to provide additional funding for the City of Burley streets department and the continued construction, repair, and maintenance of City of Burley street and costs of equipment, materials, and personnel related thereto as provided in Resolution No. 3-20 of the Burley City Council adopted on the 17th day of March, 2020?

Rock Creek Rural Fire Protection District

- Property Tax Levy

- Increase property tax levy, adding an additional $624,439

Ballot question:

Shall the Board of Commissioners of Rock Creek Rural Fire Protection District, Idaho be authorized and empowered to permanently increase the property tax levy as permitted by Section 63-802(1)(h) Idaho Code adding an additional Six Hundred Twenty-Four Thousand, Four Hundred Thirty-Nine Dollars ($624,439), provided by resolution of the Board of Commissioners of the Rock Creek Rural Fire Protection District adopted on March 5, 2020, to be voted on May 19, 2020?

The purpose of the levy is for additional personnel, apparatus, and maintaining and operating the District. The estimated average annual cost to the taxpayer of the proposed permanent levy is a tax increase of Seventy-Seven Dollars and Sixteen Cents ($77.16) per One Hundred Thousand dollars ($100,000) of taxable assessed value, per year, based on current conditions. Approval of this levy override is necessary to increase the protection of its resident's public health, life, and property.

Valley Vu of Malta Cemetery District

- Permanent Override Levy

- $12,282.91 per year

Ballot question:

Shall the Board of Directors of the Valley Vu of Malta Cemetery District be authorized to levy a permanent override levy in the amount of $12,282.91 per year on a permanent basis commencing with the fiscal year beginning 2021, for the purpose of paying all lawful expenses as provided in the resolution of the Board of Directors of the Valley Vu of Malta Cemetery District adopted on February 18, 2020?

The estimated average annual cost to the taxpayer on the proposed levy is a tax of $20.00 per $100,000 of taxable assessed value, per year, based on current conditions.

Custer County

Legislative District 8

State Senator

- CON Kirsten Faith Richardson

- REP Marla Lawson

- REP Steven Thayn

State Representative, Position A

- REP Terry Gestrin

State Representative, Position B

- REP Dorothy Moon

- REP LaVerne Sessions

County Offices

County Commissioner, First District

- REP Wayne F. Butts

County Commissioner, Second District

- REP Randy Corgatelli

County Sheriff

- REP Scott Drexler

- REP Stu Lumpkin

- REP Joel M. Peterson

County Prosecutor

- REP Jason Mackrill

- REP Justin B. Oleson

Elmore County

Legislative District 23

State Senator

- DEM Laura Bellegante

- REP Brenda Richards

- REP Christy Zito

State Representative, Position A

- DEM Benjamin Lee

- REP Matthew Bundy

- REP Andrea Owens

State Representative, Position B

- CON Tony Ullrich

- DEM Michael Oliver

- REP Megan C. Blanksma

County Offices

County Commissioner, First District

- REP Franklin "Bud" Corbus

County Commissioner, Second District

- REP Christie Batruel

- REP Nathan Jones

- REP Crystal Rodgers

- REP Wes Wootan

County Sheriff

- REP Mike Barclay

- REP Russell A. Griggs

- REP Mike Hollinshead

- REP Bob Peace

County Coroner

- Nickie M. Campbell

County Prosecutor

- Daniel R. Page

Ballot Questions

Mountain Home School District No. 193

- Supplemental Levy

- $2,700,000 per year for two years

Ballot question:

Shall the Board of Trustees be authorized to levy a supplemental levy in the amount of $2.7 million per year for a period of two years commencing with the fiscal year beginning July 1, 2020, for the purpose of paying all lawful expenses of operating the schools of the district as provided in the resolution of the Board of Trustees adopted on February 18, 2020.

-Supplemental Levy of $2.7 million is a zero increase in the levy amount

-Approximately $186.51 per $100,000 of value

-Approximately $1.8651 per $1,000 of value

Bliss Joint School District No. 234

- Plant Facilities Reserve Fund Levy

- $50,000 per year for 10 years

Ballot question:

Shall the Board of Trustees of Bliss Jt. School District No. 234, Gooding, Twin Falls, Elmore Counties, Idaho be authorized and empowered to levy a School Plant Facilities Reserve Fund levy in the amount of $50,000 - Fifty Thousand Dollars and no/100, for the first fiscal year beginning July 1, 2020 and continuing each year in the amount of $50,000 Fifty Thousand Dollars and no/100 for 10 years for the purpose of allowing the District to acquire, purchase or improve school site or sites; to accumulate funds for and to build a school house or school house remodel or repair any existing building; to furnish and equip any building or buildings, including all lighting, heating, ventilation and sanitation facilities and appliances necessary to maintain and operate buildings of the District; to purchase school buses; for lease and lease purchase agreements for any of the above purposes and to repay loans from commercial lending institutions extended to pay for the construction of school plant facilities?

The estimated average annual cost to the taxpayer on the proposed levy is a tax of $47 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy will replace the District's existing plant levy which currently costs $40 per $100,000. The District's Plant Levy will increase by $7 per $100,000 per year.

Gem County

Legislative District 8

State Senator

- CON Kirsten Faith Richardson

- REP Marla Lawson

- REP Steven Thayn

State Representative, Position A

- REP Terry Gestrin

State Representative, Position B

- REP Dorothy Moon

- REP LaVerne Sessions

County Offices

County Commissioner, First District

- REP Norvil Bryan Elliott

County Commissioner, Second District

- REP Bill Butticci

County Sheriff

- REP Donnie Wunder

County Prosecutor

- REP Erick B. Thomson

Gooding County

Legislative District 26

State Senator

- DEM Michelle Stennett

- REP Eric Parker

State Representative, Position A

- DEM Muffy Davis

State Representative, Position B

- DEM Sally J Toone

- REP William K Thorpe

County offices

County Commissioner, First District

- REP Susan Bolton

- REP Jerry D. Pierce

County Commissioner, Second District

- REP Mark E. Bolduc

County Sheriff

- REP Shaun Gough

County Prosecutor

- REP Trevor Misseldine

- REP Matt Pember

Ballot Questions

Bliss Joint School District No. 234

- Plant Facilities Reserve Fund Levy

- $50,000 per year for 10 years

Ballot question:

Shall the Board of Trustees of Bliss Jt. School District No. 234, Gooding, Twin Falls, Elmore Counties, Idaho be authorized and empowered to levy a School Plant Facilities Reserve Fund levy in the amount of $50,000 - Fifty Thousand Dollars and no/100, for the first fiscal year beginning July 1, 2020 and continuing each year in the amount of $50,000 Fifty Thousand Dollars and no/100 for 10 years for the purpose of allowing the District to acquire, purchase or improve school site or sites; to accumulate funds for and to build a school house or school house remodel or repair any existing building; to furnish and equip any building or buildings, including all lighting, heating, ventilation and sanitation facilities and appliances necessary to maintain and operate buildings of the District; to purchase school buses; for lease and lease purchase agreements for any of the above purposes and to repay loans from commercial lending institutions extended to pay for the construction of school plant facilities?

The estimated average annual cost to the taxpayer on the proposed levy is a tax of $47 per $100,000 of taxable assessed value, per year, based on current conditions. The proposed levy will replace the District's existing plant levy which currently costs $40 per $100,000. The District's Plant Levy will increase by $7 per $100,000 per year.

Hagerman Fire Protection District

- Temporary Override Levy

- $125,000 per year for two years

Ballot question:

Shall the Board of Commissioners of Hagerman Fire Protection District be authorized to levy a temporary override levy in the amount of $125,000 per year for a period of two (2) years commencing with the fiscal year beginning 2021, for the purpose of defraying personnel costs associated with provisions for licensed services by the Hagerman Fire Protection District, 24 hours a day, 365 days a year as provided in the resolution of the Hagerman Fire Protection District adopted on February 14, 2020?

The estimated average annual cost to the taxpayer on the proposed levy based on the data above is a tax of $70.00 per $100,000 of taxable assessed values based on current conditions.

Jerome Joint School District No. 261 (Jerome, Gooding, Lincoln counties)

- General Obligation Bonds

- $26,000,000

- To fund construction of a new elementary school and remodel/repairs of existing schools

Ballot question:

Shall the Board of Trustees of Jerome Jt. School District No. 261, Jerome, Gooding, and Lincoln Counties, State of Idaho ("Board") be authorized to issue general obligation school bonds of said District, in one or more series, in a principal amount not to exceed $26,000,000 for the purpose of constructing a new elementary school; financing the addition, remodel and/or repair of the existing Jefferson and Horizon elementary school buildings; and to repair or equip any other buildings necessary to maintain and operate the buildings of the District, such series of bonds to become due in such installments as may be fixed by the Board, for a term not to exceed twenty years, all as provided in the Resolution adopted by the Board on February 25, 2020?

The interest rate anticipated on the proposed bond issue is 2.42% per annum. The total amount estimated to be repaid over the life of the bonds, based on the anticipated interest rate, is $26,668,966 consisting of $26,000,000 in principal and $7,215,800 of interest, totaling $33,215,800, less $6,546,834 in estimated bond levy equalization payments. The term of the bonds will not exceed 20 years. The total existing bonded indebtedness of the District, including interest accrued, is $36,411,475. The estimated average annual cost to the taxpayer on the proposed bond levy is a tax of $88 per $100,000 of taxable assessed value, per year, based on current conditions. The District's existing levies for prior bonds and other levy items are expected to decrease by $88 per $100,000 resulting in no net change in the District's total property tax rate if the proposed bonds are approved.

Wendell School District No. 232

- Supplemental Levy

- $600,000 per year for two years

Ballot question:

Shall the Board of Trustees of School District No. 232, Gooding County, State of Idaho, be authorized and empowered to levy a Supplemental Levy in the amount of six hundred thousand and no/ dollars ($600,000.00) per year for two (2) years, commencing with the fiscal year beginning July 1, 2020 and ending June 30, 2022, for the purpose of financing any lawful expenses of maintaining and operating the District; all as provided in the Resolution adopted by the Board of Trustees on February 18, 2020?

The estimated average annual cost to the taxpayer on the proposed levy is a tax of $158 per $100,000 of taxable assessed value, per year, based on current conditions. Currently, the District collects a supplemental levy authorized in the same amount of $600,000, which will expire when the proposed levy goes into effect.

Idaho County

Legislative District 7

State Senator

- REP Carl G. Crabtree

State Representative, Position A

- REP Priscilla Giddings

- REP Dennis Harper

State Representative, Position B

- REP Cornel Rasor

- REP Charlie Shepherd

County Offices

County Commissioner, First District

- REP R. Skipper “Skip” Brandt

County Commissioner, Second District

- REP Ted Lindsley

County Sheriff

- REP Doug Giddings

- REP Doug Ulmer

County Prosecutor

- REP Kirk A. MacGregor

Ballot Questions

Mountain View School District No. 244

- Supplemental Levy

- $3,900,000 per year for one year

Ballot question:

Shall the Board of Trustees of Mountain View School District No. 244, Idaho County, Idaho, be authorized to levy a supplemental levy in the amount of $3,900,000, three million nine hundred thousand dollars for one year for the fiscal year beginning July 1, 2020 and ending June 30, 2021 for the purpose of paying all lawful expenses of maintaining and operating the schools of the District for the fiscal year as provided in the resolution of the Board of Trustees of Mountain View School District #244 adopted on March 16, 2020?

The estimated average annual cost to the taxpayer on the proposed levy based on the data above is a tax of $422.00 per $100,000 of taxable assessed values based on current conditions.

Nezperce Joint School District No. 302

- Supplemental Levy

- $445,000 per year for one year

Ballot question:

Shall the Board of Trustees of Nezperce Joint School District No. 302 be authorized to levy a supplemental levy in the amount of $445,000 per year for a period of one year commencing with the fiscal year beginning July 1, 2020, for the purpose of maintenance and operation of the school district.

The estimated average annual cost to the taxpayer on the proposed levy based on the data above is a tax of $342.30 per $100,000 of taxable assessed values based on current conditions.

Salmon River Joint School District (Idaho and Adams counties)

- Supplemental Levy

- $525,000 per year for one year

Ballot question:

Shall the Board of Trustees of Salmon River Joint School District #243, Idaho and Adams Counties, State of Idaho be authorized to levy a Supplemental Levy in the amount of ($525,000.00) per year for a period of one year commencing with the fiscal year beginning July 1, 2020, for the purpose of paying all lawful expenses of maintaining and operating the schools of the District as provided in the resolution of the Board of Trustees of Salmon River Joint School District #243 adopted on February 18, 2020.

The estimated average annual cost to the taxpayer on the proposed levy based on the data above is a tax of $3.81 per $1000.00 of taxable assessed values based on the current conditions.

Jerome County

Legislative District 25

State Senator

- REP Jim Patrick

State Representative, Position A

- REP Laurie Lickley

State Representative, Position B

- REP Clark Kauffman

County Offices

County Commissioner, First District

- REP A. Ben Crouch

County Commissioner, Second District

- REP Charles M Howell

County Sheriff

- REP George Oppedyk Jr.

County Prosecutor

- REP Michael J. Seib

Ballot Questions

Jerome Joint School District No. 261 (Jerome, Gooding, Lincoln counties)

- General Obligation Bonds

- $26,000,000

- To fund construction of a new elementary school and remodel/repairs of existing schools

Ballot question:

Shall the Board of Trustees of Jerome Jt. School District No. 261, Jerome, Gooding, and Lincoln Counties, State of Idaho ("Board") be authorized to issue general obligation school bonds of said District, in one or more series, in a principal amount not to exceed $26,000,000 for the purpose of constructing a new elementary school; financing the addition, remodel and/or repair of the existing Jefferson and Horizon elementary school buildings; and to repair or equip any other buildings necessary to maintain and operate the buildings of the District, such series of bonds to become due in such installments as may be fixed by the Board, for a term not to exceed twenty years, all as provided in the Resolution adopted by the Board on February 25, 2020?

The interest rate anticipated on the proposed bond issue is 2.42% per annum. The total amount estimated to be repaid over the life of the bonds, based on the anticipated interest rate, is $26,668,966 consisting of $26,000,000 in principal and $7,215,800 of interest, totaling $33,215,800, less $6,546,834 in estimated bond levy equalization payments. The term of the bonds will not exceed 20 years. The total existing bonded indebtedness of the District, including interest accrued, is $36,411,475. The estimated average annual cost to the taxpayer on the proposed bond levy is a tax of $88 per $100,000 of taxable assessed value, per year, based on current conditions. The District's existing levies for prior bonds and other levy items are expected to decrease by $88 per $100,000 resulting in no net change in the District's total property tax rate if the proposed bonds are approved.

Lincoln County

Legislative District 26

State Senator

- DEM Michelle Stennett

- REP Eric Parker

State Representative, Position A

- DEM Muffy Davis

State Representative, Position B

- DEM Sally J Toone

- REP William K Thorpe

County Offices

County Commissioner, First District

- REP Rick Ellis

- REP Joann H. Rutler

- REP Davis Schoolcraft

County Commissioner, Second District

- REP Margo D. Harvey Tafoya

- REP Rebecca Wood

- REP Haisen Workman

County Sheriff

- REP Scott Denning

- REP R. King

County Prosecutor

- Write-in only

Malheur County (Ore.)

In addition to voting for local officials, voters in Malheur County will also choose candidates for federal (president, senator, representative) and statewide offices.

Federal Offices

President

- DEM Joseph R Biden

- DEM Bernie Sanders

- DEM Elizabeth Warren

- DEM Tulsi Gabbard

- REP Donald J Trump

US Senator

- DEM Jeff Merkley

- REP Paul J Romero Jr

- REP Robert Schwartz

- REP Jo Rae Perkins

- REP John Verbeek

US Representative, 2nd District

- DEM Jack Howard

- DEM John P Holm

- DEM Nick (Nik) L Heuertz

- DEM Alex Spenser

- DEM Chris Vaughn

- REP Mark R Roberts

- REP Knute C Buehler

- REP Cliff Bentz

- REP Kenneth W Medenbach

- REP Jeff Smith

- REP Travis A Fager

- REP Justin Livingston

- REP Jimmy Crumpacker

- REP Glenn Carey

- REP David R Campbell

- REP Jason A Atkinson

State Offices

Secretary of State

- DEM Mark D Hass

- DEM Jamie McLeod-Skinner

- DEM Shemia Fagan

- REP Kim Thatcher

- REP Dave W Stauffer

State Treasurer

- DEM Tobias Read

- REP Jeff Gudman

Attorney General

- DEM Ellen Rosenblum

- REP Michael Cross

State Senator, 30th District

- DEM Carina M Miller

- REP Lynn P Findley

State Representative, 60th District

- DEM Beth E Spell

- DEM Isabelle Fleuraud

- REP Mark Owens

County Offices

County Commissioner, Position 2

- DEM Byron Shock

- REP Jim Mendiola

- REP Ron Jacobs

- REP Larry Wilson

Nonpartisan Offices

Judge of the Supreme Court, Position 1

- Thomas A Balmer

- Van Pounds

Judge of the Supreme Court, Position 7

- Martha Walters

Judge of the Court of Appeals, Position 11

- Joel DeVore

- Kyle L Krohn

Judge of the Court of Appeals, Position 1

- Josephine H Mooney

Judge of the Court of Appeals, Position 12

- Erin C Lagesen

Judge of the Court of Appeals, Position 13

- Doug Tookey

Nonpartisan County Offices

County Assessor

- David J Ingram

Owyhee County

Legislative District 23

State Senator

- DEM Laura Bellegante

- REP Brenda Richards

- REP Christy Zito

State Representative, Position A

- DEM Benjamin Lee

- REP Matthew Bundy

- REP Andrea Owens

State Representative, Position B

- CON Tony Ullrich

- DEM Michael Oliver

- REP Megan C. Blanksma

County Offices

County Commissioner, First District

- REP Jerry Hoagland

County Commissioner, Second District

- REP Kelly R. Aberasturi

- REP Lathrop D. Callaway

County Sheriff

- REP Perry Grant

- REP Robert M. “Rocky” Widner

County Prosecutor

- REP Jeffrey L. Phillips

Payette County

Legislative District 9

State Senator

- REP Abby Lee

State Representative, Position A

- REP Ryan Kerby

- REP Jim Smith

State Representative, Position B

- DEM Allen Schmid

- REP Judy Boyle

County Offices

County Commissioner, First District

- REP Georgia Hanigan

County Commissioner, Second District

- REP Marc Shigeta

County Sheriff

- REP Andrew "Andy" Creech

County Prosecutor

- REP Ross Pittman

Twin Falls County

Legislative District 23

State Senator

- DEM Laura Bellegante

- REP Brenda Richards

- REP Christy Zito

State Representative, Position A

- DEM Benjamin Lee

- REP Matthew Bundy

- REP Andrea Owens

State Representative, Position B

- CON Tony Ullrich

- DEM Michael Oliver

- REP Megan C. Blanksma

Legislative District 24

State Senator

- REP Lee Heider

State Representative, Position A

- CON Paul Thompson

- REP Lance Clow

State Representative, Position B

- REP Linda Wright Hartgen

Legislative District 25

State Senator

- REP Jim Patrick

State Representative, Position A

- REP Laurie Lickley

State Representative, Position B

- REP Clark Kauffman

County Offices

County Commissioner, First District

- REP Dave Hansen

- REP Brent D. Reinke

County Commissioner, Second District

- REP Don Hall

County Sheriff

- REP Tom Carter

- REP Jeremy Maritt

- REP Steve Pankey

County Prosecutor

- REP Grant Loebs

Ballot Questions

Hagerman Fire Protection District

- Temporary Override Levy

- $125,000 per year for two years

Ballot question:

Shall the Board of Commissioners of Hagerman Fire Protection District be authorized to levy a temporary override levy in the amount of $125,000 per year for a period of two (2) years commencing with the fiscal year beginning 2021, for the purpose of defraying personnel costs associated with provisions for licensed services by the Hagerman Fire Protection District, 24 hours a day, 365 days a year as provided in the resolution of the Hagerman Fire Protection District adopted on February 14, 2020?

The estimated average annual cost to the taxpayer on the proposed levy based on the data above is a tax of $70.00 per $100,000 of taxable assessed values based on current conditions.

Rock Creek Rural Fire Protection District

- Property Tax Levy

- Increase property tax levy, adding an additional $624,439

Ballot question:

Shall the Board of Commissioners of Rock Creek Rural Fire Protection District, Idaho be authorized and empowered to permanently increase the property tax levy as permitted by Section 63-802(1)(h) Idaho Code adding an additional Six Hundred Twenty-Four Thousand, Four Hundred Thirty-Nine Dollars ($624,439), provided by resolution of the Board of Commissioners of the Rock Creek Rural Fire Protection District adopted on March 5, 2020, to be voted on May 19, 2020?

The purpose of the levy is for additional personnel, apparatus, and maintaining and operating the District. The estimated average annual cost to the taxpayer of the proposed permanent levy is a tax increase of Seventy-Seven Dollars and Sixteen Cents ($77.16) per One Hundred Thousand dollars ($100,000) of taxable assessed value, per year, based on current conditions. Approval of this levy override is necessary to increase the protection of its resident's public health, life, and property.

Valley County

Legislative District 8

State Senator

- CON Kirsten Faith Richardson

- REP Marla Lawson

- REP Steven Thayn

State Representative, Position A

- REP Terry Gestrin

State Representative, Position B

- REP Dorothy Moon

- REP LaVerne Sessions

County Offices

County Commissioner, First District

- REP Elting G. Hasbrouck

County Commissioner, Second District

- DEM Anthony Moss

- REP Sherry L. Maupin

Valley County Sheriff

- REP Patti Bolen

- REP Jim Cole

- REP Micah Haselton

- REP Joanna (Jo) Roop

- REP Jason Speer

County Prosecutor

- DEM Serhiy "Gus" Stavynskyy

- REP Brian D. Naugle

Ballot Questions

City of McCall

- General Obligation Bonds

- $6,200,000

- For construction of a new addition to the city's library facilities, and renovation of the city's existing library facilities

Ballot question:

Shall the city of McCall, Valley County, Idaho, be authorized to incur an indebtedness and issue and sell its general obligation bonds, in one or more series of bonds, in an aggregate principal amount for all such bonds of not more than $6,200,000, or so much thereof as may be necessary, for the purpose of providing funds with which to prepare, construct, and furnish a new addition to the city's library facilities, relocate the office and storage facilities of the city's park department to make room for such addition, and renovate and furnish the City's exisiting library facilities, with each of said series of bonds to be payable annually or at such lesser intervals as determined by future resolutions or ordinances of the City, and to mature serially with the final installment to fall due within twenty (20) years from the date of each of said series of bonds, and to bear interest at a rate or rates to be determined by future resolutions or ordinances of the City, all as provided in the ordinance of the city adopted on february 27, 2020?

The purpose for which the proposed bonds are to be issued, the date of the special municipal bond election (May 19, 2020), and the principal amount of the bonds are set forth above on the ballot or in the proposition. The interest rate anticipated on the proposed bonds based on current market rates is 3.09% per annum. The total amount to be repaid over the life of the proposed bonds, principal and interest, based on the anticipated interest rate, is estimated to be $8,494,700, consisting of $6,200,000 in principal and $2,294,700 in interest. The estimated average annual cost of the proposed bonds based on current market conditions is a tax of $27.51 per $100,000 of taxable assessed value, per year. The proposed bonds will mature within twenty (20) years from the date of each series of bonds. The total existing indebtedness of the City, including interest accrued as of May 19, 2020, is $1,379,943.94.

Washington County

Legislative District 9

State Senator

- REP Abby Lee

State Representative, Position A

- REP Ryan Kerby

- REP Jim Smith

State Representative, Position B

- DEM Allen Schmid

- REP Judy Boyle

County Offices

County Commissioner First District

- REP Lisa Collini

- REP Lyndon Haines

County Commissioner Second District

- REP Nathan "Nate" Marvin

County Sheriff

- REP Matthew Thomas

County Prosecutor

- REP Delton Walker

Ballot Questions

Weiser Hospital District

- General Obligation Bonds

- $6,500,000

- For construction of new emergency room wing

Ballot question:

Shall the Board of Trustees of Weiser Hospital District, Washington County, Idaho (the "District") be authorized to issue general obligation bonds in the amount of $6,500,000 to become due in such installments as may be fixed by the Board of Trustees of the District (th "Board"), the final installment to fall due not more than twenty (20) years from the date of such bonds, for the purpose of (i) financing a new emergency room wing with space to consolidate all radiology services, private ER access for all ambulance patients, enlargement of treatment rooms, addition of mental health holding area, updated and expanded surgical space for out-patient procedures, new parking, and all related equipment, fixtures and appliances necessary to maintain and operate said facilities, and (ii) paying the costs of issuance of such bonds, all as provided in the Bond Election Resolution adopted by the Board on February 27, 2020?

The interest rate anticipated on the proposed bond issue, based upon current market rates, is two and ninety two hundredths percent (2.92%) per annum. The amount to be repaid over the life of the bonds, based on the anticipated interest rate, is $9,035,700, in consisting of $6,500,000 in principal and $2,535,700 of interest.

The estimated average annual cost to the taxpayer on the proposed bond is a tax of $79.95 per $100,000 of taxable assessed value, per year, based on current conditions. As of May 19, 2020, the total existing bonded indebtedness of the District, including interest accrued, is $1,405, 849.