Many VERIFY readers have reached out in recent months with questions about Social Security benefits, which provide people with an income when they retire or can’t work due to disability.

We’re answering some of the most common Social Security questions, including how the benefits are calculated, whether they’re taxable, and if people can receive them based on a family member’s earnings.

THE SOURCES

- Social Security Administration (SSA)

- AARP

- Social Security Expansion Act bills in the House and Senate

- Sen. Bernie Sanders (I-Vt.)

- Social Security Expansion Act fact sheet

WHAT WE FOUND

How are Social Security retirement and disability benefits calculated?

Your Social Security retirement benefit payment is based on how much you earned throughout your career.

“Higher lifetime earnings result in high benefits,” the Social Security Administration (SSA) says. “If there were some years you didn’t work or had low earnings, your benefit amount may be lower than if you had worked steadily.”

The SSA uses a three-step process to calculate your benefits, AARP explains.

First, the agency adjusts your earnings for historical changes in U.S. wages and takes your 35 highest-paid years of work to come up with what SSA calls your average indexed monthly earnings.

Second, SSA applies a formula to that monthly average to determine your primary insurance amount (PMI), or the amount you will get each month if you claim benefits at your full retirement age (more on that later).

Third, SSA factors in the age at which you claim benefits. If you claim them before you reach full retirement age, your benefit amount will be lower.

Social Security Disability Insurance (SSDI) benefits, which provide income for people who can no longer work because of a disability, are generally calculated in the same way as retirement benefits with one key difference: how many years of income are used to determine the benefit amount.

Essentially, SSA will determine your benefit amount based on your average earnings in the years before you became disabled.

The disability benefit amount is the same as a full, unreduced retirement benefit, according to SSA. If you have Social Security disability benefits when you reach full retirement age, they will be converted to retirement benefits.

SSA has benefits calculators available on its website that can help you determine your specific payment amounts.

When can you collect Social Security retirement benefits?

When you reach full retirement age, you qualify for 100% of your monthly benefit amount.

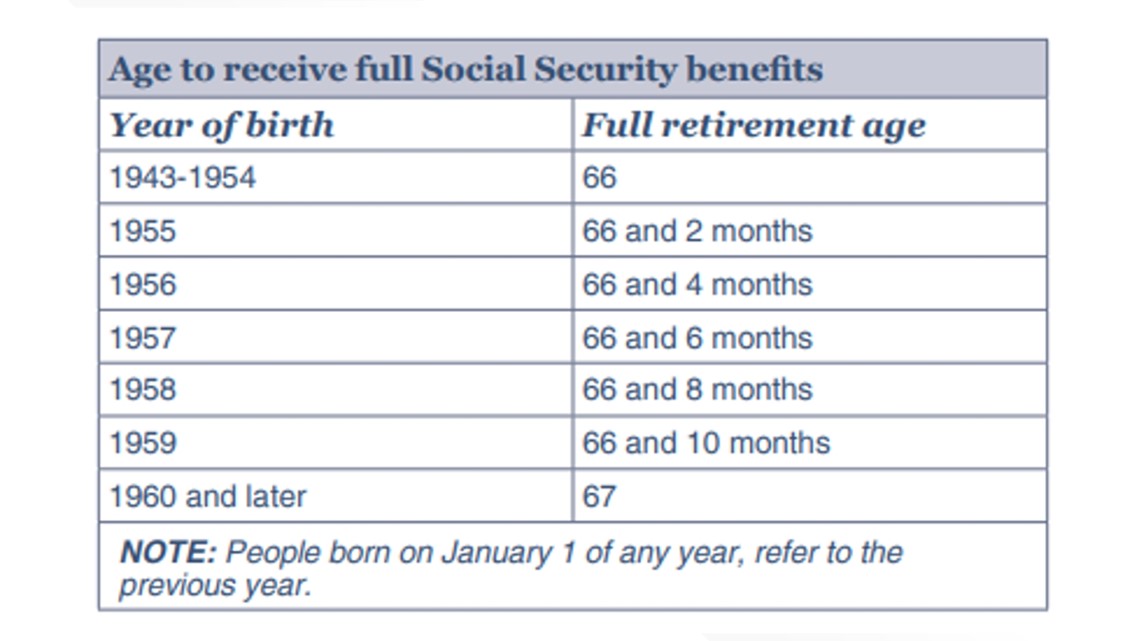

Anyone born in 1960 or later can start receiving full retirement benefits at age 67. The full retirement age gradually decreases for people born earlier than 1960.

The chart below from SSA outlines a person’s full retirement age based on their birth year. SSA also has a retirement age calculator available on its website.

You can start receiving Social Security retirement benefits as early as age 62. But your payment will be reduced if you start collecting benefits before your full retirement age.

If you wait until age 70 to apply for benefits, your payment will increase even more because you’ll accrue delayed retirement benefits, AARP explains.

Does Social Security adjust benefit amounts every year?

SSA adjusts benefit amounts every year to account for inflation through a cost-of-living adjustment (COLA).

The COLA is calculated based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), an inflation gauge measured by the U.S. Bureau of Labor Statistics (BLS). It measures the average change over time in the prices that workers are paying on a “basket of consumer goods and services.”

SSA explains on its website that the COLA is equal to the percentage increase in the CPI-W from the third quarter average of the previous year to the same average from the current year. If there is an increase, it’s rounded to the nearest tenth of a percent. That same increase is applied to monthly Social Security payments.

Social Security payments increased by 8.7%, or about $140 a month for the average recipient, in 2023 due to the COLA. This is the highest COLA since 1981, when it was 11.2%.

Are Social Security recipients getting an extra $200 in their checks?

Several VERIFY readers have asked if they will see an extra $200 per month in their Social Security checks, on top of the COLA increase. The answer is no.

A proposed bill called the Social Security Expansion Act did include a $200 monthly increase in Social Security benefits for new and existing recipients, separate from the COLA. That means people would have seen an extra $2,400 per year on average.

The Social Security Expansion Act was introduced in both the House and Senate in June 2022. But the legislation didn’t pass.

That means it needs to be reintroduced in 2023.

Sen. Bernie Sanders (I-Vt.) announced in a press release on Feb. 13 that he and Sen. Elizabeth Warren (D-Mass.) are reintroducing the Social Security Expansion Act in the Senate.

Reps. Jan Schakowsky (D-Ill.) and Val Hoyle (D. Ore.) are reintroducing the bill in the House, Sanders said.

Congress would still need to pass the legislation before President Biden could sign it into law.

Are Social Security benefits taxable?

You’ll have to pay federal taxes on a portion of your Social Security benefits if your income falls within certain levels. These benefits include monthly retirement, survivor and disability benefits. Supplemental Security Income (SSI) payments are never taxed, the IRS says.

For a full breakdown of how much your Social Security benefits will be federally taxed based on your income, click here.

Twelve states also tax some or all of residents’ Social Security benefits, according to AARP. You can find more information about individual states here.

Can family members receive Social Security benefits after a person dies?

The widow or widower of a deceased person who received Social Security benefits can receive monthly checks after the person dies. These are called survivors benefits.

Surviving spouses are eligible for monthly benefits if they are age 60 or older, or age 50 or older if the survivor has a disability. They will receive between 71.5% to 100% of their late spouse’s Social Security benefit, depending on their age, AARP says.

In addition, a widow or widower of any age can collect survivors benefits if they are caring for the deceased’s child who is younger than age 16 and or has a disability.

There are some other factors that could impact a surviving spouse’s payments, such as whether they already receive Social Security benefits.

Surviving divorced spouses can also receive the same benefits as a widow or widower if the marriage lasted 10 years or more. The eligibility rules are largely the same as well, according to AARP.

Other family members can also receive survivors benefits.

They include:

- An unmarried child of the deceased who is younger than 18 (or up to age 19 if they are a full-time student in an elementary or secondary school); or age 18 or older with a disability that began before age 22.

- Dependent parent(s) of the deceased, age 62 or older.

For a full breakdown of survivors benefit payments based on your situation and how to apply, click here.

Can people collect Social Security benefits based on their living ex-spouse’s earnings?

If you are divorced from someone who is entitled to Social Security benefits, you may be eligible to receive a percentage of the benefits based on your ex-spouse’s earnings history, SSA says. But you have to meet certain requirements.

You must be at least 62 years old and unmarried, and the marriage to your ex-spouse must have lasted for at least 10 years. If you have since remarried, you can’t collect Social Security benefits based on your ex-spouse’s earnings history unless your later marriage ended by annulment, divorce or death.

Additionally, if you are entitled to benefits based on your own earnings history, that benefit amount must be less than what you would receive based on your ex-spouse’s work. Social Security will pay the higher of the two benefit amounts, but not both.

AARP explains that you can collect up to 50% of your ex-spouse’s benefit amount.

Ex-spouses can receive the maximum benefit amount if they file upon reaching full retirement age, AARP says. If you claim the benefits earlier, the amount is reduced.

If your ex-spouse qualifies for retirement benefits but isn’t collecting them yet, you can still claim their benefits. But the divorce must have happened at least two years prior.

For more information about benefits for divorced spouses, click here.