BOISE, Idaho — If you were to ask Idahoans for their one wish list item for the Idaho legislature to accomplish this year, good chance the answer is property tax. Idahoans around the Gem State have spoken out in recent years on how property taxes are handicapping their budgets, creating issues for families and individuals.

Well Idaho asked, lawmakers listened.

Monday was the day for the big introduction of what looks like 'the property tax relief bill for the year.’

The idea pitched in committee Monday comes as the legislative session winds down, lawmakers want to go home on March 24. The idea, presented early Monday, is actually a compromise between a couple of ideas being worked on at the Statehouse.

House Bill 77 and 79 looked to angle for a way to create property tax savings, 77 aimed to take sales tax revenues and put a portion of that towards property tax bills for Idahoans.

House Bill 79 wanted to take millions of dollars, send it to Idaho schools to help them pay down bonds and levies.

By doing that, the cost to taxpayers would go down in their property taxes. Money would also be saved up by schools so they can pay for building costs, hopefully meaning a school wouldn't need to ask for bonds and levies.

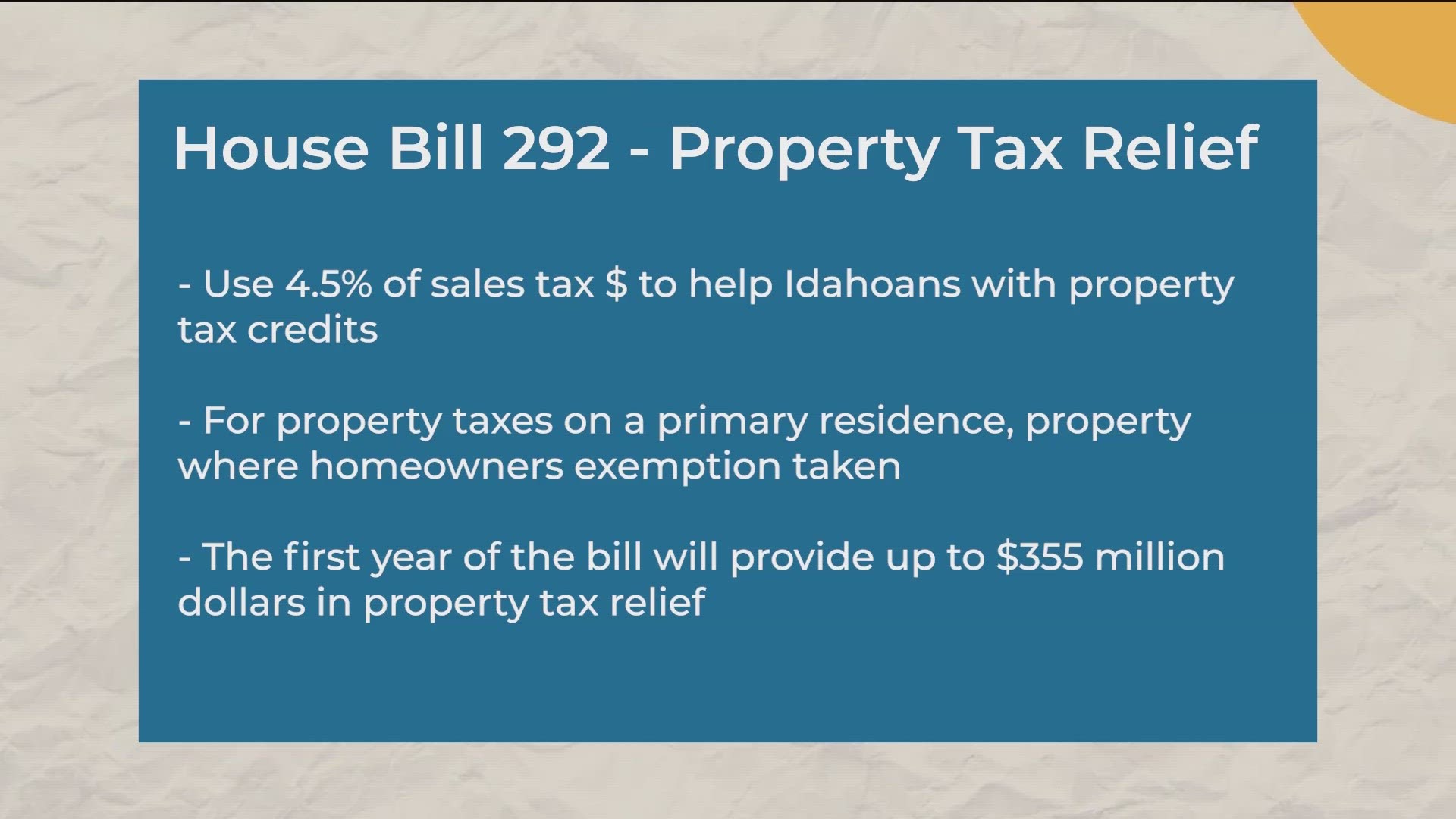

Those two big ideas are now in one piece of legislation: House Bill 292. Two new state funds to talk about in the proposal.

First, lawmakers propose taking 4.5% of annual sales tax revenue from the state to create a tax credit for primary residences, a home where the owner has their homeowners exemption.

Not the first time Idaho has used sales tax revenue to address other taxing concerns, but that is a pretty straight forward end result, tax money is used to help Idahoans pay their property taxes down.

There is a caveat here, lawmakers crafted the bill so property tax relief credits will not go towards school bonds and levies that voters approve on their own.

The logic, voters agreed to raise their taxes for a community project.

One of the bill sponsors, Senator Scott Grow, explains the rationale and net result they are looking to accomplish with the tax credits.

"Every homeowner will receive the same percentage reduction in their property tax. So, for example, if you had a $3,000 property tax, then whatever that tax total of all of the different things added up to, mine would be a specific dollar amount that was directed as relief towards the things that you can't vote on, non-school kinds of things. And so everyone will receive the same percentage, whether in the wealthy district, rural district or wherever you're getting the same percentage, not the same dollars, but the same percentage of relief," Grow said.

The other big part of this bill deals with bonds and levies and sending money to schools.

As mentioned in House Bill 79 from House Speaker Moyle and Rep. Monks, dedicating millions of dollars to send to Idaho schools for the purpose of addressing needs that bonds and levies have had to cover in recent years.

Things like building maintenance and construction, expensive tax projects that communities need to do but raise taxes. The idea is to send money to every school district money for their facilities, it's called the school district facilities fund. Districts would be sent money based on their daily average attendance.

The bill outlines that money send to districts need to be used on specific order: (1) payment of school bonds (2) payment of school levies (3) save for future school facility construction needs (4) use for new bonds.

The concept here, avoid running bonds and levies so communities don't have to raise their property taxes.

There is a compromise idea here with school advocates though, the bill eliminates the March election date that school districts use for bonds and levies.

Quinn Perry with the Idaho School Boards Association expressed concerns with that portion of the bill.

"This date is used by an overwhelming majority of school districts, especially those who rely on supplemental levies to maintain the operations of their public schools. As you can imagine, predictability and stability or two key factors in operating Idaho's public school systems. And we believe that removing this (March) date is removing the one that provides the most in predictability and stability," Perry told the committee.

Democrat Rep. Lauren Necocchea echoed those as well.

"These levy elections are a conversation with voters. So if they can keep the March levy and it doesn't pass, then they can say, okay, voters didn't support us at this level. Let's see if they support us at this level and then try again in May and just gives us more options to do everything they can to retain the teachers and other staff that our kids need so that they can learn in school," Necocchea said.

One of the many co-sponsors on the idea, Rep. Jason Monks, addressed those concerns in committee, he explained the tradeoff he envisioned.

“What we are doing is we are providing a mechanism for bonding and levees. We're providing additional money to where we're removing that ability from the taxpayers to have to vote an increase on themselves. And so, because we're providing this additional money for them, we felt it was appropriate to remove one of those dates,” Monks said.

He says the March election date was selected for removal based on how budget [processes and budget requests go in the early part of the calendar year.

“You have to have that information in 50 days prior to that, which so we're talking the end of January. They have to already submit the language that they want for that bond or levy, as you guys are well aware we're barely starting hearings within JFAC, and they have not yet set their budgets on how much the schools will receive for bonds and levies,” Monks said. “It didn't seem appropriate that they'd be asking for additional money from the taxpayers when they don't even know what they're base salary.”

So, who is left holding the bag here?

The bill sponsors are adamant that this is a setup idea that is not a tax shift, so the idea is nobody is on the hook for an issue here in terms of a shifting tax burden.

Funding for the entire idea, both piles of money for tax credits and schools, comes from a variety of places including, as mentioned, sales tax, tax rebate program money left over, surplus dollars, some general fund dollars, internet sales tax coffers, to name the major ones.

The program also re-calibrated the circuit breaker program, that is the one that helps disabled and elderly Idahoans with their property taxes, some eligibility for that was expanded in the pitch as well.

The idea passed the house committee, now heads to full house for debate and vote.

Join 'The 208' conversation:

- Text us at (208) 321-5614

- E-mail us at the208@ktvb.com

- Join our The 208 Facebook group: https://www.facebook.com/groups/the208KTVB/

- Follow us on Twitter: @the208KTVB or tweet #the208 and #SoIdaho

- Follow us on Instagram: @the208KTVB

- Bookmark our landing page: /the-208

- Still reading this list? We're on YouTube, too: