BOISE, Idaho — The Idaho State Legislature has printed numerous bills focused on providing property tax relief to Idahoans; however, none of these bills have made it out of committee two months into the 2023 Legislative Session.

The 2023 Boise State University Public Policy Survey reported 55.9% of Idahoans consider their property tax bills to be 'too high.' The state does not collect or spend property taxes; these taxes are dependent on local county and city budgets.

This can make offering relief a difficult line to walk, according to Speaker of the House Rep. Mike Moyle (R-Star).

"The session is talking about property taxes. We are trying to find a solution. And I am sure we will," Speaker Moyle said. "You have to remember, it's complicated."

The House currently holds three bills in the Taxation and Revenue Committee.

- House Bill 77 (HB77) sponsored by Sen. Scott Grow (R-Eagle)

- House Bill 78 (HB78) sponsored by Rep. Bruce Skaug (R-Nampa)

- House Bill 79 (HB79) sponsored by Rep. Jason Monks (R-Meridian)

The committee - Under Chairman Rep. Monks - introduced all three bills on Feb. 3. Each looks to provide property tax relief through different means.

HB77 would push 4.5% of the state's sales tax revenue toward property tax relief only for homeowners who use their home as a primary residency. HB78 would bring property tax relief to the same demographic through indexing the homeowner's exemption.

KTVB reported in October 2022 Skaug's homeowners exemptions bill had bipartisan support before the 2023 legislative session even began; the bill adjusts the maximum amount a homeowner can exempt from property taxes based on the current housing market.

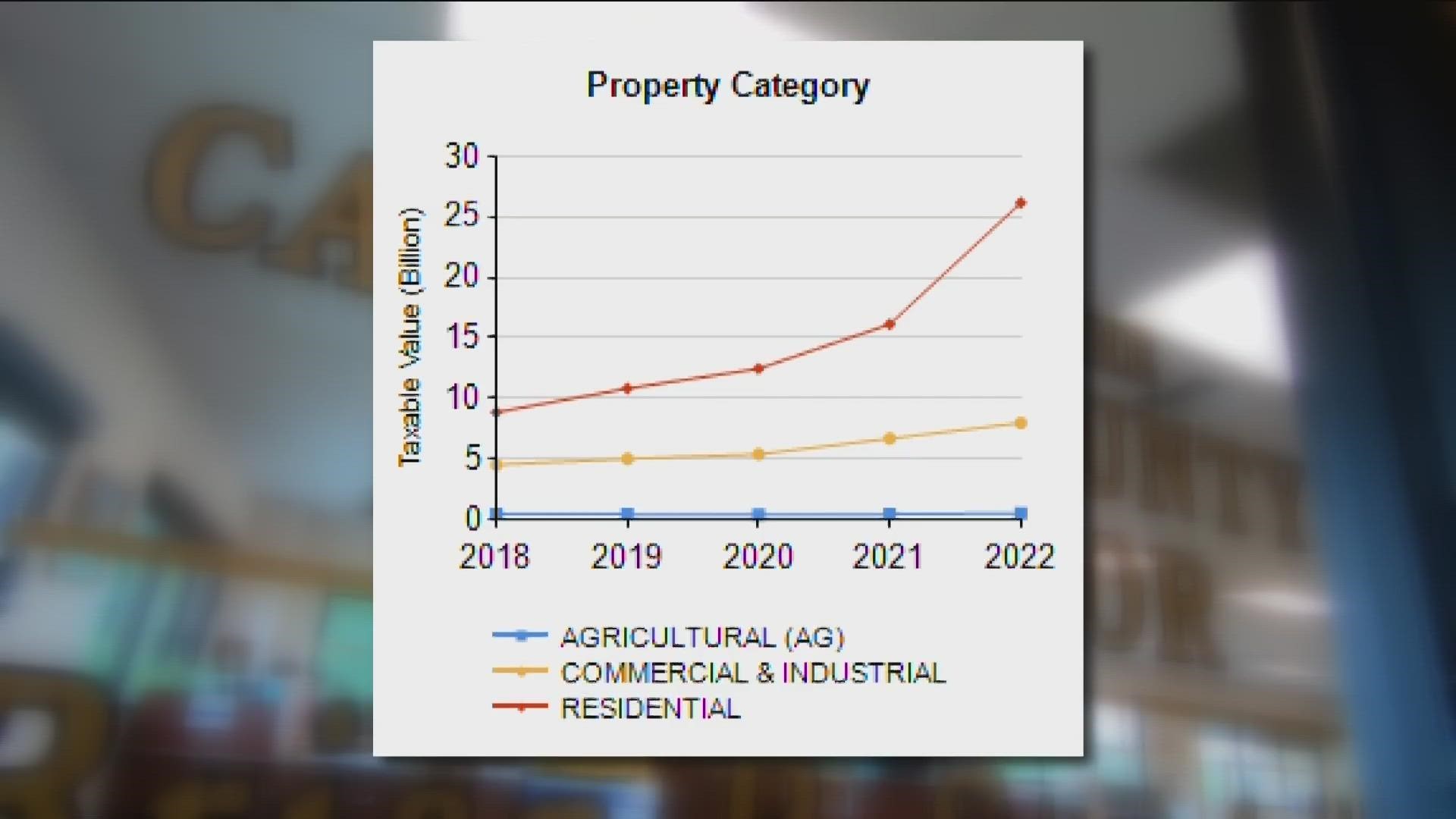

Canyon County Assessor Brian Stender told KTVB in June 2022 his county has seen an increased property tax burden on residential properties since 2018 when compared to agricultural or industrial land.

However, Speaker Moyle has concerns about both HB77 and HB78.

"When you start picking winners and losers is when I start having problems," Speaker Moyle said. "In my opinion, it should be fair to everybody. It shouldn't be for certain groups. [HB77 and HB78] are [tailored] to certain taxpaying groups."

Speaker Moyle is in favor of HB79; he co-sponsors the legislation.

"[It] has more stuff in it not only to address homeowners, but everyone else," Speaker Moyle said. "So, we're trying to touch all the bases."

HB79 aims to distribute $300 million toward Idaho School Districts to pay off bonds and levies. Funds can also be saved for future needs and development. The bill would also increase the maximum homeowner’s exemption from $125,000 to $150,000.

"Everybody in this valley probably has a supplemental on their property tax bill. Monks bill will pay them down or off depending on how much you have an provide property tax for everybody," Speaker Moyle said.

Speaker Moyle argues providing property tax relief to all properties will also help renters; it at the very least will not provide an incentive for landlords to raise rent "if they're doing the right thing."

If the tax burden is shifted directly from residents onto business and corporations, Speaker Moyle expects a negative unintended consequence.

"Corporations are animals that make money. If I raise your taxes, you are gonna raise your costs. And you're gonna pass those onto the consumer. It's stupid," Speaker Moyle said. "Why not do it right the first time and treat everybody the same? Why would we have tax policy that picks winners and losers?"

The Idaho Democrats released a statement Wednesday in support of reaching an agreement on a potential property tax relief solution. The party endorsed Senate Bill 1111 (SB1111) introduced by Sen. Grow later in month of February.

SB1111 is largely similar to HB77; it would use sales tax revenue to subsidize property tax bills for homeowners in their primary residency.

“This legislation could go further and undo the underlying tax shift, which is the major cause of rising property taxes for homeowners,” Sen. Ali Rabe (D-Garden City) said.

Sen. Rabe - alongside Sen. Rick Just (D-Boise) - also expressed support for Rep. Skaug's HB78 to index the maximum homeowner’s exemption.

Speaker Moyle expects the House and Senate to find an agreement on property tax relief this session; if not, the state surplus funds can be used elsewhere to the benefit of taxpayers.

"We have this surplus. If we'e not gonna take this money and give it to property tax relief, we would have given it back to you like we did the last couple years in income tax relief," Speaker Moyle said. "The money is coming from somewhere. If we don't give it to you there, we will give it to you somewhere else."

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist: