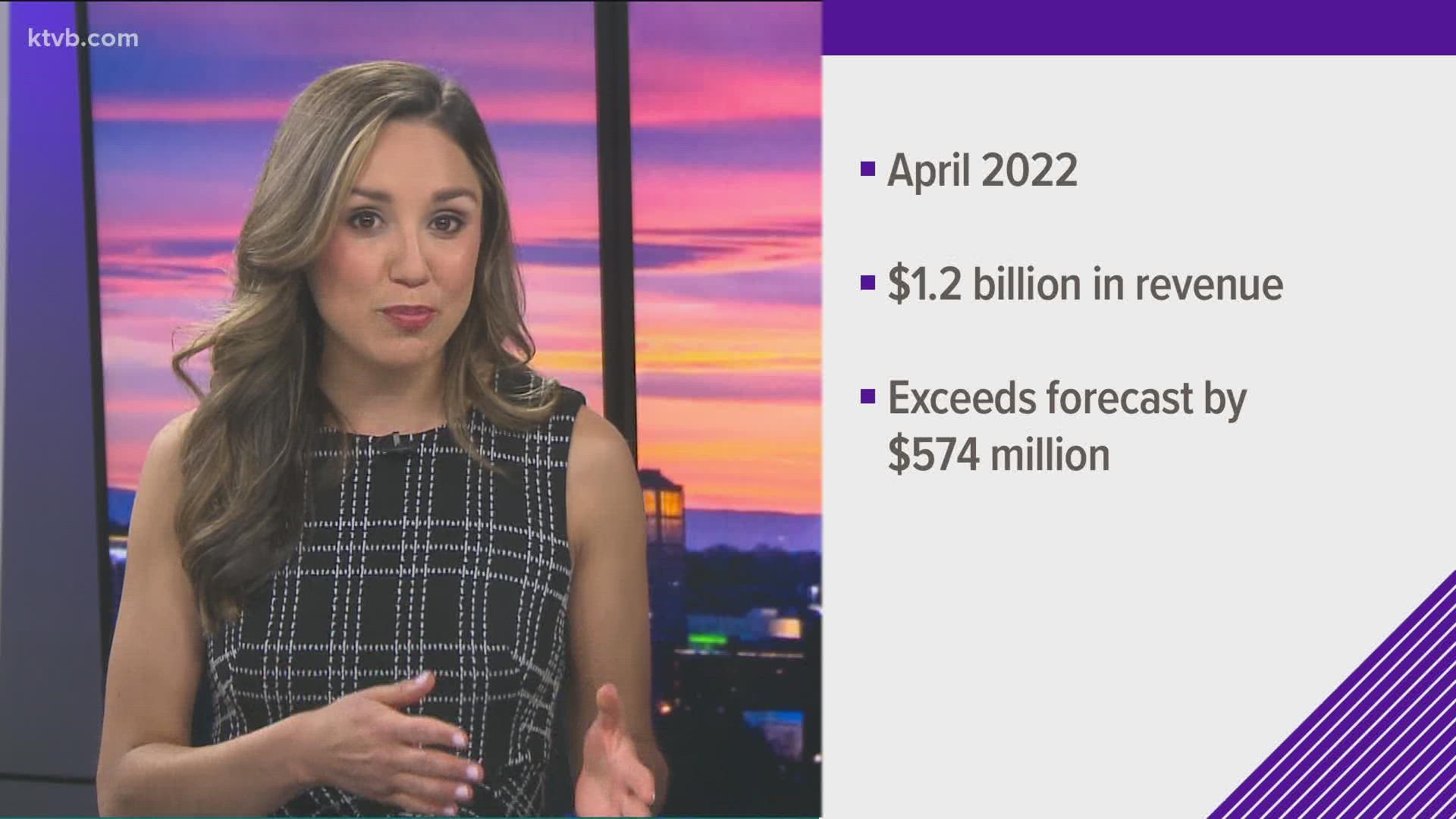

BOISE, Idaho — Idaho Gov. Brad Little is promising more tax cuts after state budget officials on Tuesday reported April tax revenue came in nearly double what had been expected.

The Republican governor in a statement attributes the $1.2 billion April tax revenues to conservative principles. The April revenue includes about $700 million in income tax and $300 million in corporate income tax.

Little earlier this year signed into law a record $600 million income tax cut. House Bill 436 includes a one-time $350 million in rebates and $250 million in permanent income tax reductions going forward for people and businesses.

The law consolidates Idaho’s income tax brackets from five down to four, and lowers both the corporate income tax and the highest individual tax rate down to 6%.

The rebate includes 12% of state income taxes returned for filers during 2020, or $75 per taxpayer and dependent, whichever is greater.

The tax cut is the largest in Idaho state history. Lawmakers split largely along party lines, with proponents arguing that it would give money back to citizens and opponents saying that it disproportionately benefits the wealthy.

Little signed the bill in a ceremony back on Feb. 4.

Little is running for a second term as Idaho's 33rd governor. Lt. Gov. Janice McGeachin of Idaho Falls is hoping to unseat Little, along with Ed Humphreys, who walked away from financial practice to focus on running for governor.

Watch more Idaho politics:

See all of our latest political coverage in our YouTube playlist: