BOISE, Idaho — Last week, the Growing Idaho story was about how Idaho's lower wage earners, specifically minimum wage earners, could never afford a home. Justin Corr’s post on Facebook got more than 230 comments. The KTVB post got more than 1,200 comments. Let's look at some.

Sid Franz said, "Supply and demand - we need a lot more homes to normalize the market - everyone is moving here."

Here's a look at the latest Idaho supply and demand numbers from Redfin for May. The supply is still not there, as Sid said. The number of homes for sale is up and new listings are up, year over year. But they're only on the market for about 32 days, they're selling even quicker than last year.

Also, our supply is at 3 months. That's the same as last year and half of the ideal supply of 6 months.

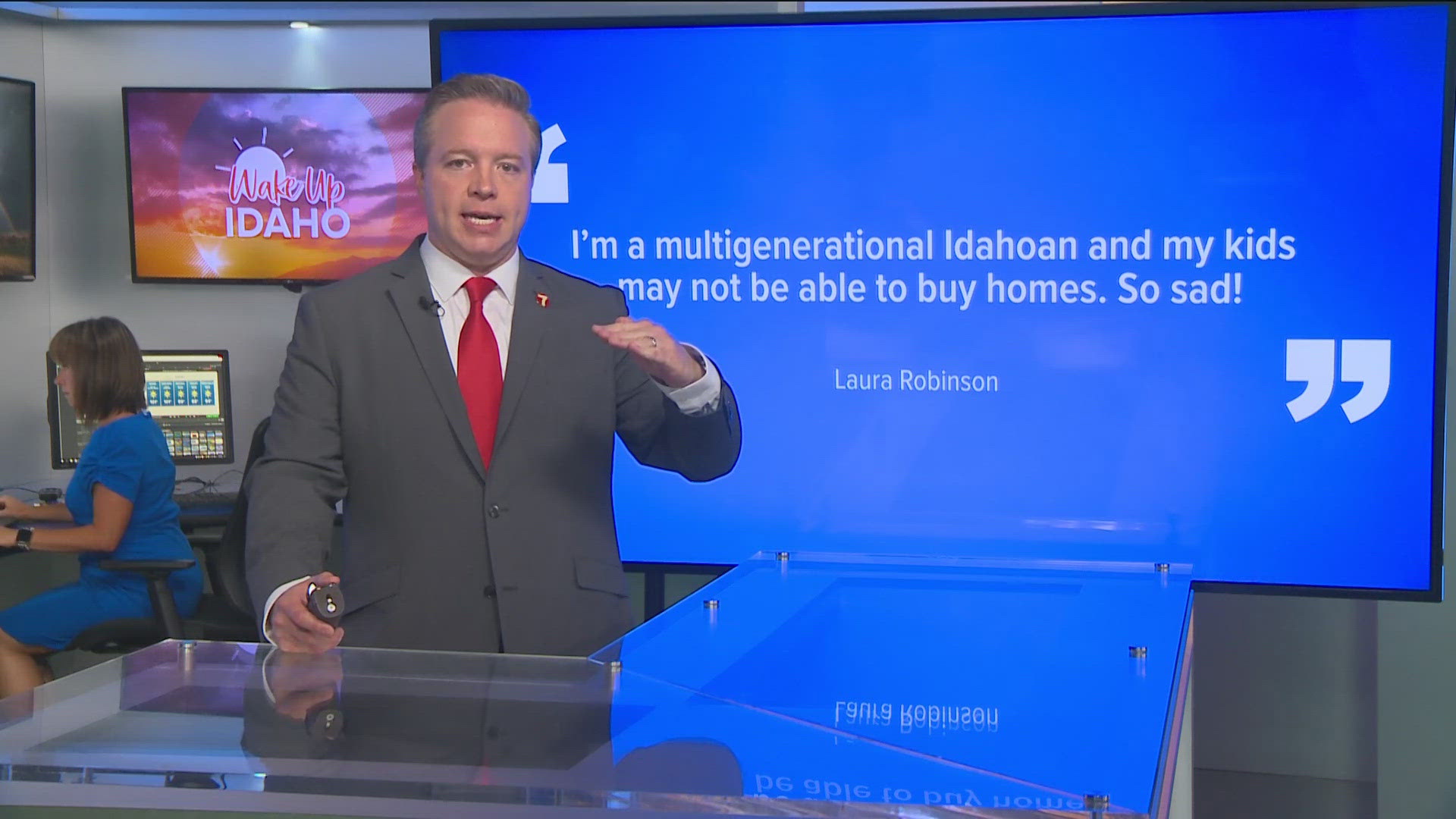

The next comment comes from Laura Robinson who said, "I'm a multigenerational Idahoan and my kids may not be able to buy homes. So sad!" This sentiment was shared by lots of folks who said prices are spiking and wages have just not kept up in the past couple decades.

We talked to a lender, Kim Demma, even before all these comments, about the big changes she's seen in her 25 years in the business. She agreed, it used to be a lot easier to get approved for a home loan... too easy, "All you had to do was fog a mirror and you could get a loan. You can't make this stuff up. And then now the pendulum has swung, so it's a little bit more normalized, where you actually have to be able to afford the house you're buying."

This last quote we'll talk about comes from Kevin who said this about folks struggling to buy a home. "They can afford designer coffees, the newest phone/tablet, new furniture all the time, a new car every few years, a new wardrobe every month, etc… Sacrificing 'self-image' will go a long way."

You might bristle at this. And yes, not going to Starbucks is not going to allow you to afford a home.

But let's focus on the big-ticket items here, especially the new car comment. Kim Demma, again, even before seeing this comment, talked about what she thinks needs to happen for us to climb out of this housing crisis. She talked about the things we already discussed, more inventory and higher wages.

She also thinks folks need more responsible personal budgeting, especially when it comes to cars. "What I believe is going to get us out the quickest is getting debt under control, and I mean, personal debt. We all know that credit card debt has gone up, because people in this inflationary environment, they've had to use credit cards to survive. But where I see the biggest problem is our obsession with our vehicles. We don't all need to have a fancy new car… I tell people, especially my first-time homebuyers, you can have a house or you can have debt, but you can't have both. So, pick which one is most important to you."

Demma broke down the numbers too. She says eliminating one $450 a month car payment would allow you to afford $65,000 more in a home.

Some folks also commented, essentially, forget about buying a house... I'm having trouble affording rent. Which is why affordable housing developments are so needed right now.